DIRECTV 2009 Annual Report Download - page 95

Download and view the complete annual report

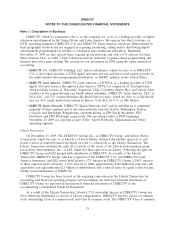

Please find page 95 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

Advertising Costs

We expense advertising costs primarily in ‘‘Subscriber acquisition costs’’ in the Consolidated

Statements of Operations as incurred. Advertising expenses, net of payments received from

programming content providers for marketing support, were $317 million in 2009, $301 million in 2008,

and $261 million in 2007.

Market Concentrations and Credit Risk

We sell programming services and extend credit, in amounts generally not exceeding $200 each, to

a large number of individual residential subscribers throughout the United States and most of Latin

America. As applicable, we maintain allowances for anticipated losses.

Accounting Changes

Noncontrolling interests. On January 1, 2009 we adopted new accounting standards for the

accounting and reporting of noncontrolling interests in subsidiaries, also known as minority interests, in

consolidated financial statements. The new standards also provide guidance on accounting for changes

in the parent’s ownership interest in a subsidiary and establishes standards of accounting for the

deconsolidation of a subsidiary due to the loss of control. Reporting entities must now present certain

noncontrolling interests as a component of equity and present net income and consolidated

comprehensive income attributable to the parent and the noncontrolling interest separately in the

consolidated financial statements. These new standards are required to be applied prospectively, except

for the presentation and disclosure requirements, which must be applied retrospectively for all periods

presented. As a result of our adoption of these standards, ‘‘Net income’’ in the Consolidated

Statements of Operations now includes net income attributable to noncontrolling interest as compared

to the previous presentation, where net income attributable to the noncontrolling interest was deducted

in the determination of net income. Additionally, the Consolidated Statements of Cash Flows are now

presented using net income as calculated pursuant to the new accounting requirements.

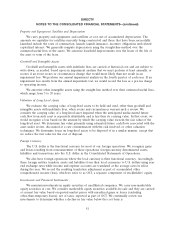

On January 1, 2009 we adopted the revisions made by the SEC to accounting standards regarding

the financial statement classification and measurement of equity securities that are subject to

mandatory redemption requirements or whose redemption is outside the control of the issuer. The

revisions to the accounting guidance require that redeemable noncontrolling interests, such as Globo

Comunicacoes e Participacoes S.A.’s, or Globo’s, redeemable noncontrolling interest in Sky Brazil

described in Note 19 of the Notes to the Consolidated Financial Statements that are redeemable at the

option of the holder be recorded outside of permanent equity at fair value, and the redeemable

noncontrolling interests be adjusted to their fair value at each balance sheet date. Adjustments to the

carrying amount of a redeemable noncontrolling interest are recorded to retained earnings (or

additional paid-in-capital in the absence of retained earnings). As a result of the adoption of this

accounting requirement, we have reported Globo’s redeemable noncontrolling interest in Sky Brazil in

‘‘Redeemable noncontrolling interest’’ at fair value in the Consolidated Balance for each period

presented. See Note 19 for additional information.

83