DIRECTV 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

Collar Loan

As part of the Liberty Transaction completed on November 19, 2009, we assumed a credit facility

with a principal balance of $1,878 million and related equity collars which were in a liability position

with an estimated acquisition date negative fair value of $369 million, which we refer to as the Collar

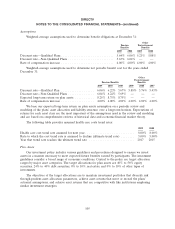

Loan. The loan bears interest at an effective weighted average interest rate of approximately 3.5%.

The equity collars, which use DTV shares as the underlying security, were entered into by Liberty

prior to the Liberty Transaction for the purpose of providing credit security to the lending bank on the

Collar Loan and, as a consequence, hedging Liberty’s exposure to default on the Collar Loan by

limiting Liberty’s exposure to downward movements in the price of DTV stock in exchange for

Liberty’s increased exposure to upward movements in the price of DTV stock. As the derivative

financial instruments were in respect of DTV stock, the original hedging function of the equity collars

ceased upon the completion of the Liberty Transaction by reason of the acquisition of the DTV stock

underlying the hedge by DIRECTV, and we became exposed to significant potential cash liability upon

any upward movements in the price of DTV stock.

Thus, the equity collars, when acquired by DIRECTV in the Liberty Transaction, posed an

unhedged risk of substantial economic loss upon upward movements in the price of DTV stock, which

was adverse to the company’s short and long-term operational and stock price goals and was therefore

an uneconomic and burdensome obligation to DIRECTV. Accordingly, in connection with the

assumption of the Collar Loan, we agreed with the lending bank to promptly repay the Collar Loan

and settle the equity collars. From the acquisition date to December 31, 2009, we repaid a total of

$751 million, including $676 million in principal payments and $75 million in payments to settle a

portion of the equity collars. We also recorded a $105 million loss during the year ended December 31,

2009 in ‘‘Liberty transaction and related charges’’ in the Consolidated Statements of Operations related

to the partial settlement of the collar and the adjustment of the remaining collar derivative financial

instruments to their fair value as of December 31, 2009 to a liability of $400 million. During the first

quarter of 2010, we paid $1,537 million to repay the remaining principal balance of the loan and settle

the equity collars, and accordingly will report a gain of approximately $65 million in the first quarter of

2010 related to the Collar Loan.

We account for the collar pursuant to the accounting standards for derivatives and hedging, which

require that all derivatives, whether designated in hedging relationships or not, are recorded on the

balance sheet at fair value. The collar is not designated as a hedge, and therefore changes in the fair

value of the derivative are recognized in earnings. We determine the fair value of the collar using the

Black- Scholes Model. Changes in the fair value of the collar are recorded in ‘‘Liberty transaction and

related charges’’ in the Consolidated Statements of Operations. Our use of the Black-Scholes Model to

value the collar is considered a Level 2 valuation technique, which uses observable inputs such as

exchange-traded equity prices, risk-free interest rates, dividend yields and volatilities.

See Note 3 for further discussion of the Liberty Transaction.

2009 Financing Transactions

On September 22, 2009, DIRECTV U.S. issued $1,000 million in five-year 4.750% senior notes

due in 2014 at a 0.3% discount resulting in $997 million of proceeds and $1,000 million in 10 year

5.875% senior notes due in 2019 at a 0.7% discount resulting in $993 million of proceeds in private

placement transactions. Principal on these senior notes is payable upon maturity, while interest is

payable semi-annually commencing April 1, 2010. We incurred $14 million of debt issuance costs in

connection with these transactions. The senior notes have been fully and unconditionally guaranteed,

95