DIRECTV 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

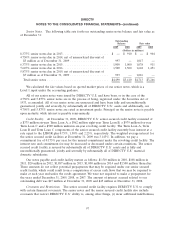

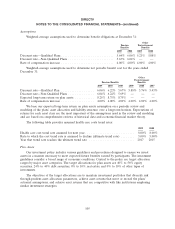

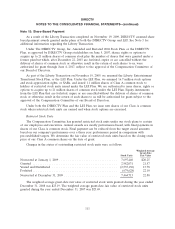

Estimated Future Benefit Payments

We expect the following benefit payments, which reflect expected future service, as appropriate, to

be paid by the plans during the years ending December 31:

Estimated Future Benefit Payments

Other Postretirement

Pension Benefits Benefits

(Dollars in Millions)

2010 .............................................. $ 45 $2

2011 .............................................. 41 2

2012 .............................................. 41 2

2013 .............................................. 38 2

2014 .............................................. 39 2

2015-2019 .......................................... 218 9

We maintain 401(k) plans for qualified employees. We match a portion of our employee

contributions and our match amounted to $16 million in 2009, $12 million in 2008 and $10 million in

2007.

We have disclosed certain amounts associated with estimated future postretirement benefits other

than pensions and characterized such amounts as ‘‘other postretirement benefit obligation.’’

Notwithstanding the recording of such amounts and the use of these terms, we do not admit or

otherwise acknowledge that such amounts or existing postretirement benefit plans of our company

(other than pensions) represent legally enforceable liabilities of us.

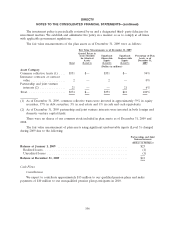

Note 13: Stockholders’ Equity

Capital Stock and Additional Paid-In Capital

Our certificate of incorporation provides for the following capital stock: Class A common stock,

par value $0.01 per share, 3,500,000,000 shares authorized; Class B common stock, par value $0.01 per

share, 30,000,000 shares authorized; Class C common stock, par value $0.01 per share, 420,000,000

shares authorized; and preferred stock, par value $0.01 per share, 50,000,000 shares authorized. As of

December 31, 2009, there were no shares outstanding of the Class C common stock or preferred stock.

Class A and Class B common stock have similar dividend distribution rights.

Share Repurchase Program

Since 2006 our Board of Directors has approved multiple authorizations for the repurchase of our

common stock, the most recent of which was announced in February 2010, authorizing share

repurchases of $3.5 billion. The authorizations allow us to repurchase our common stock from time to

time through open market purchases and negotiated transactions, or otherwise. The timing, nature and

amount of such transactions will depend on a variety of factors, including market conditions, and the

program may be suspended, discontinued or accelerated at any time. The sources of funds for the

purchases under the remaining authorizations are our existing cash on hand, cash from operations and

potential additional borrowings. Purchases are made in the open market, through block trades and

other negotiated transactions. Repurchased shares are retired but remain authorized for registration

and issuance in the future.

107