DIRECTV 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

commensurate with the risk involved, when appropriate. Estimation of future cash flows requires

significant judgment about future operating results, and can vary significantly from one evaluation to

the next. Risk adjusted discount rates are not fixed and are subject to change over time. As a result,

changes in estimated future cash flows and/or changes in discount rates could result in a write-down of

goodwill or intangible assets with indefinite lives in a future period which could be material to our

consolidated financial statements.

ACCOUNTING CHANGES AND NEW ACCOUNTING PRONOUNCEMENTS

For a discussion of accounting changes and new accounting pronouncements see Note 2 of the

Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report, which we

incorporate herein by reference.

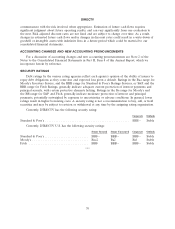

SECURITY RATINGS

Debt ratings by the various rating agencies reflect each agency’s opinion of the ability of issuers to

repay debt obligations as they come due and expected loss given a default. Ratings in the Baa range for

Moody’s Investors Service, and the BBB range for Standard & Poor’s Ratings Services, or S&P, and the

BBB range for Fitch Ratings, generally indicate adequate current protection of interest payments and

principal security, with certain protective elements lacking. Ratings in the Ba range for Moody’s and

the BB range for S&P and Fitch, generally indicate moderate protection of interest and principal

payments, potentially outweighed by exposure to uncertainties or adverse conditions. In general, lower

ratings result in higher borrowing costs. A security rating is not a recommendation to buy, sell, or hold

securities and may be subject to revision or withdrawal at any time by the assigning rating organization.

Currently, DIRECTV has the following security rating:

Corporate Outlook

Standard & Poor’s ................................................ BBBǁStable

Currently, DIRECTV U.S. has the following security ratings:

Senior Secured Senior Unsecured Corporate Outlook

Standard & Poor’s ......................... BBBǁBBBǁBBBǁStable

Moody’s ................................ Baa2 Ba2 Ba1 Stable

Fitch .................................. BBB BBBǁBBBǁStable

***

70