DIRECTV 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

LIQUIDITY AND CAPITAL RESOURCES

Our principal sources of liquidity are our cash, cash equivalents and the cash flow that we generate

from our operations. From 2007 to 2009 we experienced significant growth in net cash provided by

operating activities and free cash flow. We expect net cash provided by operating activities and free

cash flow to continue to grow and believe that our existing cash balances and cash provided by

operations will be sufficient to fund our existing business plan. Additionally, as of December 31, 2009,

DIRECTV U.S. had the ability to borrow up to $500 million under its existing credit facility, which is

available until 2011. Borrowings under this facility may be required to fund strategic investment

opportunities should they arise.

At December 31, 2009, our cash and cash equivalents totaled $2.6 billion compared with

$2.0 billion at December 31, 2008.

As a measure of liquidity, the current ratio (ratio of current assets to current liabilities) was 0.89 at

December 31, 2009 and 1.13 at December 31, 2008. Working capital decreased by $1,105 million to a

$646 million deficit at December 31, 2009 from working capital of $459 million at December 31, 2008.

The decrease during the period was mostly due to the increase in our current debt balance due to the

assumption of debt and the related equity collars as part of the Liberty Transaction.

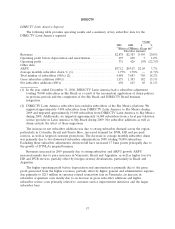

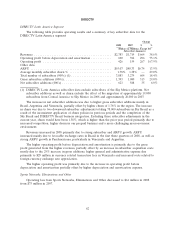

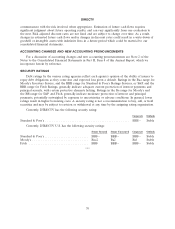

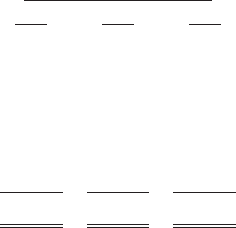

Summary Cash Flow Information

Years Ended December 31,

2009 2008 2007

(Dollars in Millions)

Net cash provided by operating activities ........................ $4,431 $ 3,910 $ 3,645

Net cash used in investing activities ............................ (2,194) (2,388) (2,822)

Net cash used in financing activities ............................ (1,637) (600) (2,239)

Free cash flow:

Net cash provided by operating activities ........................ $4,431 $ 3,910 $ 3,645

Less: Cash paid for property, equipment and satellites ............... (2,071) (2,229) (2,692)

Free cash flow ............................................ $2,360 $ 1,681 $ 953

Cash Flows Provided By Operating Activities

The increases in net cash provided by operating activities in 2009 and 2008 were primarily due to

our higher operating profit before depreciation and amortization, which resulted from the higher gross

profit generated from an increase in revenues, and in 2009 due to lower payments for income taxes

compared to 2008. Cash paid for income taxes was $484 million in 2009, $706 million in 2008 and

$408 million in 2007. The decrease in cash paid for income taxes in 2009 resulted mainly from

decreased income from continuing operations and prior year tax credits.

Cash Flows Used In Investing Activities

During both 2008 and 2009, we experienced a reduction in set-top receiver costs and benefited

from the use of refurbished set-top receivers from the DIRECTV U.S. lease program, which resulted in

a reduction in capital expenditures for property and equipment in 2008 and 2009.

Also at DIRECTV U.S., during 2007, 2008 and 2009, we were in the process of constructing three

satellites. We have completed and placed two of these satellites into service, which resulted in

decreasing satellite capital expenditures over the three year period. We expect to place the last of these

63