DIRECTV 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

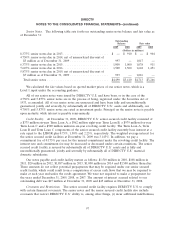

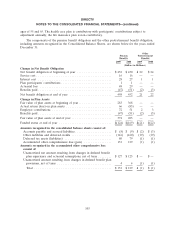

ages of 55 and 65. The health care plan is contributory with participants’ contributions subject to

adjustment annually; the life insurance plan is non-contributory.

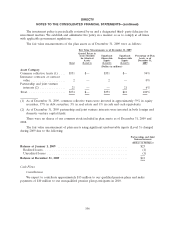

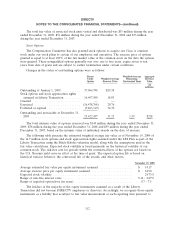

The components of the pension benefit obligation and the other postretirement benefit obligation,

including amounts recognized in the Consolidated Balance Sheets, are shown below for the years ended

December 31:

Other

Pension Postretirement

Benefits Benefits

2009 2008 2009 2008

(Dollars in Millions)

Change in Net Benefit Obligation

Net benefit obligation at beginning of year .................... $452 $430 $22 $24

Service cost ........................................... 16 16 — —

Interest cost .......................................... 28 27 1 1

Plan participants’ contributions ............................. 1 1 — —

Actuarial loss ......................................... 48 29 — —

Benefits paid .......................................... (47) (51) (2) (3)

Net benefit obligation at end of year ........................ 498 452 21 22

Change in Plan Assets

Fair value of plan assets at beginning of year ................... 283 368 — —

Actual return (loss) on plan assets .......................... 66 (85) — —

Employer contributions .................................. 72 51 2 3

Benefits paid .......................................... (47) (51) (2) (3)

Fair value of plan assets at end of year ....................... 374 283 — —

Funded status at end of year .............................. $(124) $(169) $(21) $(22)

Amounts recognized in the consolidated balance sheets consist of:

Accounts payable and accrued liabilities ..................... $ (8) $ (9) $ (2) $ (3)

Other liabilities and deferred credits ....................... (116) (160) (19) (19)

Deferred tax assets (liabilities) ........................... 80 79 (1) (1)

Accumulated other comprehensive loss (gain) ................ 131 129 (1) (1)

Amounts recognized in the accumulated other comprehensive loss

consist of:

Unamortized net amount resulting from changes in defined benefit

plan experience and actuarial assumptions, net of taxes ........ $127 $125 $— $—

Unamortized amount resulting from changes in defined benefit plan

provisions, net of taxes ............................... 4 4 (1) (1)

Total ............................................ $131 $129 $ (1) $ (1)

103