DIRECTV 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

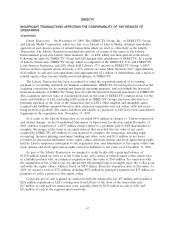

SIGNIFICANT TRANSACTIONS AFFECTING THE COMPARABILITY OF THE RESULTS OF

OPERATIONS

Acquisitions

Liberty Transaction. On November 19, 2009, The DIRECTV Group, Inc., or DIRECTV Group,

and Liberty Media Corporation, which we refer to as Liberty or Liberty Media, obtained shareholder

approval of and closed a series of related transactions which we refer to collectively as the Liberty

Transaction. The Liberty Transaction included the split-off of certain of the assets of the Liberty

Entertainment group into Liberty Entertainment, Inc., or LEI, which was then split-off from Liberty.

Following the split-off, DIRECTV Group and LEI merged with subsidiaries of DIRECTV. As a result

of Liberty Transaction, DIRECTV Group, which is comprised of the DIRECTV U.S. and DIRECTV

Latin America businesses, and LEI, which held Liberty’s 57% interest in DIRECTV Group, a 100%

interest in three regional sports networks, a 65% interest in Game Show Network, LLC, approximately

$120 million in cash and cash equivalents and approximately $2.1 billion of indebtedness and a series of

related equity collars became wholly-owned subsidiaries of DIRECTV.

The Liberty Transaction has been accounted for using the acquisition method of accounting

pursuant to accounting standards for business combinations. DIRECTV Group has been treated as the

acquiring corporation for accounting and financial reporting purposes, and accordingly the historical

financial statements of DIRECTV Group have become the historical financial statements of DIRECTV.

The acquisition date fair value of consideration paid, in the form of DIRECTV common stock, for the

assets and liabilities of LEI (excluding LEI’s interest in DIRECTV Group) has been allocated to a

premium expensed at the close of the transaction and to LEI’s other tangible and intangible assets

acquired and liabilities assumed based on their estimated acquisition date fair values, with any excess

being treated as goodwill. The assets, liabilities and results of operations of LEI have been consolidated

beginning on the acquisition date, November 19, 2009.

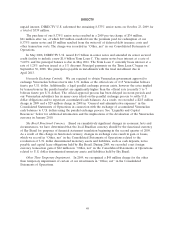

As a result of the Liberty Transaction, we recorded $491 million in charges to ‘‘Liberty transaction

and related charges’’ in the Consolidated Statements of Operations for the year ended December 31,

2009, which is comprised of: a $337 million charge related to a premium paid to LEI shareholders to

complete the merger in the form of an equity interest that exceeded the fair value of net assets

acquired by DIRECTV; $43 million of costs incurred to complete the transaction, including legal,

accounting, financial printing, investment banking and other costs; and $111 million in net losses

recorded for the partial settlement of the equity collars and stock options and stock appreciation rights

held by Liberty employees subsequent to the acquisition date, and adjustments of the equity collars and

stock options and stock appreciation rights carried as liabilities to fair value as of December 31, 2009.

As part of the Liberty Transaction, we assumed a credit facility with a principal balance of

$1,878 million, which we refer to as the Collar Loan, and a series of related equity collars which were

in a liability position with an estimated acquisition date fair value of $369 million. In connection with

the assumption of the Collar Loan, we agreed with the lending bank to promptly repay the Collar Loan

and settle the equity collars, which is based on DTV shares. From the acquisition date to December 31,

2009, we repaid a total of $751 million, including $676 million in principal payments and $75 million in

payments to settle a portion of the equity collars.

Cash paid, net of cash acquired in connection with the transaction was $97 million and includes a

$226 million repayment of LEI’s existing loan from Liberty at the close of the transaction and

$43 million of cash paid for transaction costs, partially offset by $120 million in cash at LEI, and

$56 million of cash at the regional sports networks.

47