DIRECTV 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

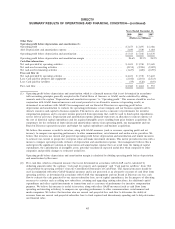

unpaid interest. DIRECTV U.S. redeemed the remaining 8.375% senior notes on October 23, 2009 for

a total of $339 million.

The purchase of our 8.375% senior notes resulted in a 2009 pre-tax charge of $34 million,

$21 million after tax, of which $29 million resulted from the premium paid for redemption of our

8.375% senior notes and $5 million resulted from the write-off of deferred debt issuance costs and

other transaction costs. The charge was recorded in ‘‘Other, net’’ in our Consolidated Statements of

Operations.

In May 2008, DIRECTV U.S. issued $1.5 billion in senior notes and amended its senior secured

credit facility to include a new $1.0 billion Term Loan C. The senior notes bear interest at a rate of

7.625% and the principal balance is due in May 2016. The Term Loan C currently bears interest at a

rate of 5.25% and was issued at a 1% discount. Principal payments on the Term Loan C began on

September 30, 2008. The principal is payable in installments with the final installment due in

April 2013.

Venezuela Exchange Controls. We are required to obtain Venezuelan government approval to

exchange Venezuelan bolivars fuerte into U.S. dollars at the official rate of 2.15 Venezuelan bolivars

fuerte per U.S. dollar. Additionally, a legal parallel exchange process exists, however the rates implied

by transactions in the parallel market are significantly higher than the official rate (recently 5 to 7

bolivars fuerte per U.S. dollar). The official approval process has been delayed in recent periods and

our Venezuelan subsidiary has in many cases relied on the parallel exchange process to settle U.S.

dollar obligations and to repatriate accumulated cash balances. As a result, we recorded a $213 million

charge in 2009 and a $29 million charge in 2008 in ‘‘General and administrative expenses’’ in the

Consolidated Statements of Operations in connection with the exchange of accumulated Venezuelan

cash balances to U.S. dollars using the parallel exchange process. See ‘‘Liquidity and Capital

Resources’’ below for additional information and the implications of the devaluation of the Venezuelan

currency in January 2010.

Sky Brazil Functional Currency. Based on cumulatively significant changes in economic facts and

circumstances, we have determined that the local Brazilian currency should be the functional currency

of Sky Brazil for purposes of financial statement translation beginning in the second quarter of 2009.

As a result of this change in functional currency, changes in exchange rates result in gain or losses,

which we record in ‘‘Other, net’’ in the Consolidated Statements of Operations related to the

revaluation of U.S. dollar denominated monetary assets and liabilities, such as cash deposits, notes

payable and capital lease obligations held by Sky Brazil. During 2009, we recorded a net foreign

currency transaction gain of $62 million in ‘‘Other, net’’ in the Consolidated Statements of Operations

related to U.S. dollar denominated monetary assets and liabilities held by Sky Brazil.

Other Than Temporary Impairment. In 2009, we recognized a $45 million charge for the other

than temporary impairment of certain of our investments in ‘‘Other, net’’ in the Consolidated

Statements of Operations.

49