DIRECTV 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

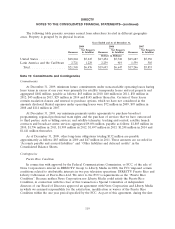

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

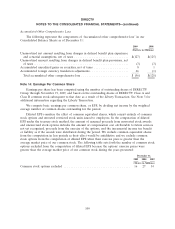

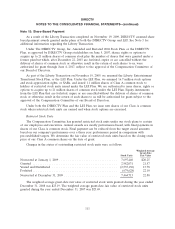

accounting rules for non-employee awards. We include that liability within ‘‘Other liabilities and

deferred credits’’ in our Consolidated Balance Sheets. Of the 16.7 million equity instruments assumed

on November 19, 2009, 8.8 million were held by persons other than employees or directors. As of

December 31, 2009, 4.0 million non-employee awards remain outstanding with a fair value of

approximately $61 million. The intrinsic value of awards carried as liabilities which were exercised

during the period was $67 million. During the year ended December 31, 2009, we recorded a net loss

of $6 million to ‘‘Liberty transaction and related charges’’ in the Consolidated Statements of

Operations for gains and losses recognized for exercised options and the adjustment of the liability to

fair value as of December 31, 2009.

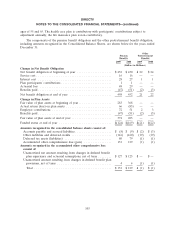

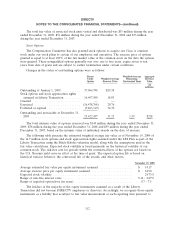

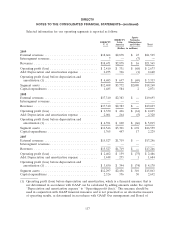

The following table presents the estimated weighted average fair value as of December 31, 2009

for the equity instruments issued to persons other than employees and directors carried as a liability

using the Black-Scholes valuation model along with the assumptions used in the fair value calculations.

Expected stock volatility is based primarily on the historical volatility of our common stock. The

risk-free rate for periods within the contractual lives of the options are based on the U.S. Treasury

yield curve in effect at the time of grant. The expected option life is based on the contractual life of

the awards.

December 31, 2009

Average estimated fair value per equity instrument assumed ................... $ 15.19

Average exercise price per equity instrument assumed ........................ $ 20.06

Expected stock volatility ............................................. 25.2%

Range of risk-free interest rates ........................................ 0.19 - 3.34%

Range of expected option lives (in years) ................................. 0.6 - 7.4

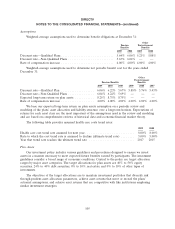

The following table presents the estimated weighted average fair value for stock options granted

under the DIRECTV Plan using the Black-Scholes valuation model along with the assumptions used in

the fair value calculations. Expected stock volatility is based primarily on the historical volatility of our

common stock. The risk-free rate for periods within the contractual life of the option is based on the

U.S. Treasury yield curve in effect at the time of grant. The expected option life is based on historical

exercise behavior and other factors.

2007

Estimated fair value per option granted ........................................ $ 8.27

Average exercise price per option granted ....................................... 22.43

Expected stock volatility .................................................... 22.5%

Risk-free interest rate ..................................................... 4.65%

Expected option life (in years) ............................................... 7.0

There were no stock options granted under the DIRECTV Plan during the years ended

December 31, 2008 and 2009.

113