DIRECTV 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

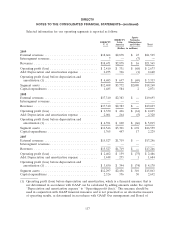

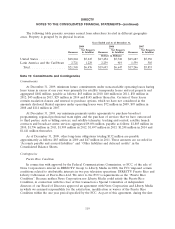

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

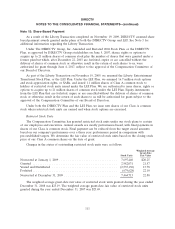

quarter of 2008, we received a $160 million cash capital contribution, which we recorded as ‘‘Additional

paid-in-capital’’ in the Consolidated Balance Sheets.

In order to comply with terms of the FCC order, effective February 25, 2009, we placed the shares

of DIRECTV Puerto Rico into a trust and appointed an independent trustee who oversees the

management and operation of DIRECTV Puerto Rico, and has the authority, subject to certain

conditions, to divest ownership of DIRECTV Puerto Rico. We cannot be sure that the FCC will agree

with our view that the trust is sufficient to sever all attributable links between DIRECTV and Liberty,

or that it will not require us to undertake further cumbersome and expensive measures to eliminate

such attribution. We continue to consolidate the results of DIRECTV Puerto Rico.

Redeemable Noncontrolling Interest

In connection with our acquisition of Sky Brazil in 2006, our partner who holds the remaining

25.9% interest, Globo was granted the right, until January 2014, to require us to purchase all or a

portion (but not less than half) of its shares in Sky Brazil. Upon exercising this right, the fair value of

Sky Brazil shares will be determined by mutual agreement or by an outside valuation expert, and we

have the option to elect to pay for the Sky Brazil shares in cash, shares of our common stock or a

combination of both. As of December 31, 2009, we estimate that Globo’s 25.9% equity interest in Sky

Brazil has a fair value of approximately $400 million to $550 million. As of December 31, 2008, we

estimate that Globo’s 25.9% equity interest in Sky Brazil had a fair value of approximately $325 million

to $450 million. Adjustments to the carrying amount of the redeemable noncontrolling interest were

recorded to additional paid-in-capital. We determined the range of fair values using significant

unobservable inputs including forecasted operating results, which are Level 3 inputs pursuant to fair

value accounting standards.

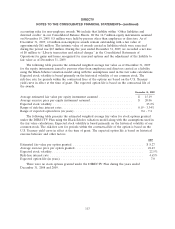

Litigation

Litigation is subject to uncertainties and the outcome of individual litigated matters is not

predictable with assurance. Various legal actions, claims and proceedings are pending against us arising

in the ordinary course of business. We have established loss provisions for matters in which losses are

probable and can be reasonably estimated. Some of the matters may involve compensatory, punitive, or

treble damage claims, or demands that, if granted, could require us to pay damages or make other

expenditures in amounts that could not be estimated at December 31, 2009. After discussion with

counsel representing us in those actions, it is the opinion of management that such litigation is not

expected to have a material adverse effect on our consolidated financial statements.

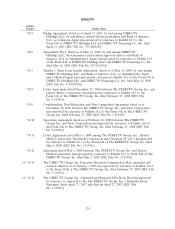

Finisar Corporation. As previously reported, we were successful in 2008 getting the jury verdict in

the Finisar case vacated on appeal. The original verdict found the patent to be valid and willfully

infringed, and the jury awarded approximately $79 million in damages. The trial court increased the

damages award by $25 million because of the jury finding of willful infringement and awarded

pre-judgment interest of $13 million. DIRECTV was also ordered to pay into escrow $1.60 per new

set-top receiver manufactured for use with the DIRECTV system beginning June 17, 2006 and

continuing until the patent expires in 2012 or was otherwise found to be invalid. On April 18, 2008, the

Court of Appeals reversed the verdict of the district court in part, vacated the findings of infringement,

and remanded for further proceedings on the remaining issues finding that the district court had

applied erroneous interpretations of certain terms of the claims. On remand, we sought and obtained

summary judgment on invalidity of all remaining claims, and the case against DIRECTV was dismissed

on May 19, 2009. Finisar filed a Notice of Appeal, and oral argument on the appeal was held on

120