DIRECTV 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

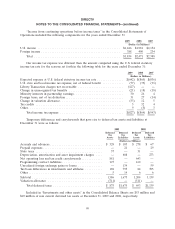

We capitalized interest costs of $18 million in 2009, $18 million in 2008, and $51 million in 2007 as

part of the cost of our property and satellites under construction. Depreciation expense was

$2,287 million in 2009, $1,907 million in 2008, and $1,264 million in 2007.

On March 1, 2006, DIRECTV U.S. introduced a set-top receiver lease program. Prior to March 1,

2006, most set-top receivers provided to new and existing DIRECTV U.S. subscribers were immediately

expensed upon activation as a subscriber acquisition or upgrade and retention cost in the Consolidated

Statements of Operations. Subsequent to the introduction of the lease program, we lease most set-top

receivers provided to new and existing subscribers, and therefore capitalize the set-top receivers in

‘‘Property and equipment, net’’ in the Consolidated Balance Sheets. We depreciate capitalized set-top

receivers over a three year estimated useful life and include the amount of set-top receivers capitalized

each period in ‘‘Cash paid for property and equipment’’ in the Consolidated Statements of Cash Flows.

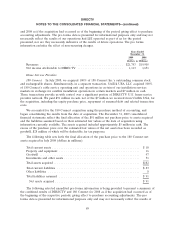

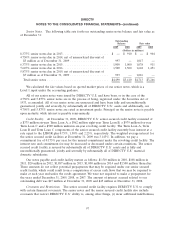

The following table sets forth the amount of DIRECTV U.S. set-top receivers we capitalized, and

depreciation expense we recorded, under the lease program for each of the periods presented:

Years ended December 31,

Capitalized subscriber leased equipment: 2009 2008 2007

(Dollars in Millions)

Subscriber leased equipment—subscriber acquisitions ........... $ 564 $ 599 $ 762

Subscriber leased equipment—upgrade and retention ........... 419 537 774

Total subscriber leased equipment capitalized ................ $ 983 $1,136 $1,536

Depreciation expense—subscriber leased equipment ............ $1,333 $1,100 $ 645

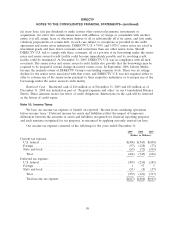

Note 6: Goodwill and Intangible Assets

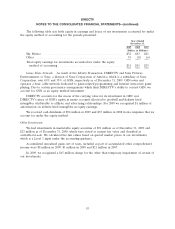

The following table sets forth the changes in the carrying amounts of ‘‘Goodwill’’ in the

Consolidated Balance Sheets by segment for the years ended December 31, 2009 and 2008:

Sports

Networks,

DIRECTV Eliminations

DIRECTV U.S. Latin America and Other Total

Balance as of January 1, 2008 ................. $3,032 $637 $ — $3,669

Acquisition related to home service provider

business ............................... 157 — — 157

Sky Brazil deferred income tax valuation allowance . — (73) — (73)

Balance as of December 31, 2008 .............. 3,189 564 — 3,753

Liberty Transaction ......................... — — 341 341

Sky Brazil foreign currency translation adjustment . . — 92 92

Purchase or acquisition accounting adjustments:

New acquisitions ......................... 24 — — 24

Finalization of prior acquisitions ............. (46) — — (46)

Balance as of December 31, 2009 .............. $3,167 $656 $341 $4,164

91