DIRECTV 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

See Note 3 of the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual

Report, which we incorporate herein by reference. Financial Statements and Supplementary Data for

additional information regarding these transactions and Amendment No. 5 to DIRECTV’s Registration

Statement on Form S-4 filed with the SEC on October 20, 2009.

180 Connect. In July 2008, we acquired 100% of 180 Connect’s outstanding common stock and

exchangeable shares. Simultaneously, in a separate transaction, UniTek USA, LLC acquired 100% of

180 Connect’s cable service operating unit and operations in certain of our installation services markets

in exchange for satellite installation operations in certain markets and $7 million in cash. These

transactions provide us with control over a significant portion of DIRECTV U.S.’ home service

provider network. We paid $91 million in cash, net of the $7 million we received from UniTek USA, for

the acquisition, including the equity purchase price, repayment of assumed debt and related transaction

costs.

Darlene Transaction. On January 30, 2007, we acquired Darlene’s 14% equity interest in

DLA LLC for $325 million in cash. We accounted for this acquisition using the purchase method of

accounting.

Other Developments

In addition to the items described above, the following items had a significant effect on the

comparability of our operating results and financial position as of and for the years ended

December 31, 2009, 2008 and 2007:

Lease Program. On March 1, 2006, DIRECTV U.S. introduced a new set-top receiver lease

program. Prior to March 1, 2006, we expensed most set-top receivers provided to new and existing

DIRECTV U.S. subscribers upon activation as a subscriber acquisition or upgrade and retention cost in

the Consolidated Statements of Operations. Subsequent to the introduction of our lease program, we

lease most set-top receivers provided to new and existing subscribers, and therefore capitalize the

set-top receivers in ‘‘Property and equipment, net’’ in the Consolidated Balance Sheets.

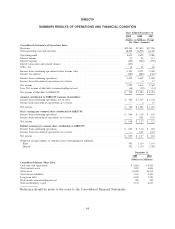

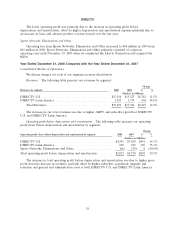

The following table sets forth the amount of DIRECTV U.S. set-top receivers we capitalized, and

depreciation expense we recorded, under the lease program for the years ended December 31:

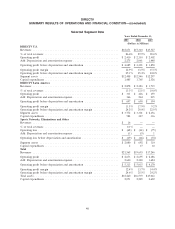

Capitalized subscriber leased equipment: 2009 2008 2007

(Dollars in Millions)

Subscriber leased equipment—subscriber acquisitions ................. $ 564 $ 599 $ 762

Subscriber leased equipment—upgrade and retention ................. 419 537 774

Total subscriber leased equipment capitalized ....................... $ 983 $1,136 $1,536

Depreciation expense—subscriber leased equipment .................. $1,333 $1,100 $ 645

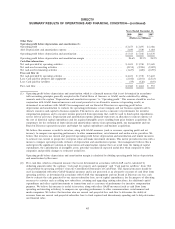

Financing Transactions. On September 22, 2009, DIRECTV U.S. issued $1 billion in five year

4.750% senior notes due in 2014 at a 0.3% discount resulting in $997 million of proceeds. DIRECTV

U.S. also issued $1 billion in 10 year 5.875% senior notes due in 2019 at a 0.7% discount resulting in

$993 million of proceeds.

On September 22, 2009, DIRECTV U.S. purchased, pursuant to a tender offer, $583 million of its

then outstanding $910 million 8.375% senior notes at a price of 103.125% plus accrued and unpaid

interest, for a total of $603 million. On September 23, 2009, DIRECTV U.S. exercised its right to

redeem the remaining $327 million of the 8.375% senior notes at a price of 102.792% plus accrued and

48