DIRECTV 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

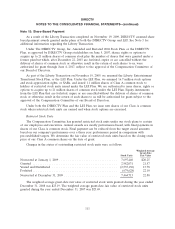

Note 15: Share-Based Payment

As a result of the Liberty Transaction completed on November 19, 2009, DIRECTV assumed share

based payment awards granted under plans of both the DIRECTV Group and LEI. See Note 3 for

additional information regarding the Liberty Transaction.

Under The DIRECTV Group, Inc. Amended and Restated 2004 Stock Plan, or the DIRECTV

Plan, as approved by DIRECTV Group stockholders on June 5, 2007, shares, rights or options to

acquire up to 21 million shares of common stock plus the number of shares that were granted under a

former plan but which, after December 22, 2003 are forfeited, expire or are cancelled without the

delivery of shares of common stock or otherwise result in the return of such shares to us, were

authorized for grant through June 4, 2017, subject to the approval of the Compensation Committee of

our Board of Directors.

As part of the Liberty Transaction on November 19, 2009, we assumed the Liberty Entertainment

Transitional Stock Plan, or the LEI Plan. Under the LEI Plan, we assumed 16.7 million stock options

and stock appreciation rights, or SARs, and issued 1.1 million shares of Class A common stock to

holders of restricted stock units issued under the LEI Plan. We are authorized to issue shares, rights or

options to acquire up to 21 million shares of common stock under the LEI Plan. Equity instruments

from the LEI Plan that are forfeited, expire or are cancelled without the delivery of shares of common

stock or otherwise result in the return of such shares to us will be authorized for grant subject to the

approval of the Compensation Committee of our Board of Directors.

Under both the DIRECTV Plan and the LEI Plan, we issue new shares of our Class A common

stock when restricted stock units are earned and when stock options are exercised.

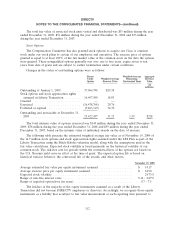

Restricted Stock Units

The Compensation Committee has granted restricted stock units under our stock plans to certain

of our employees and executives. Annual awards are mostly performance-based, with final payments in

shares of our Class A common stock. Final payment can be reduced from the target award amounts

based on our company’s performance over a three year performance period in comparison with

pre-established targets. We determine the fair value of restricted stock units based on the closing stock

price of our Class A common shares on the date of grant.

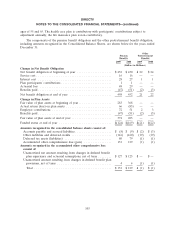

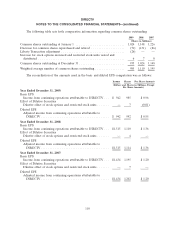

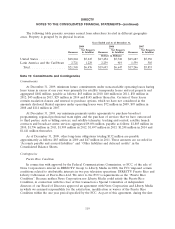

Changes in the status of outstanding restricted stock units were as follows:

Weighted-Average

Grant-Date

Stock Units Fair Value

Nonvested at January 1, 2009 ................................. 7,697,440 $20.25

Granted ................................................ 2,982,031 21.57

Vested and Distributed ..................................... (2,535,130) 13.78

Forfeited ................................................ (679,628) 22.10

Nonvested at December 31, 2009 .............................. 7,464,713 22.80

The weighted average grant-date fair value of restricted stock units granted during the year ended

December 31, 2008 was $23.19. The weighted average grant-date fair value of restricted stock units

granted during the year ended December 31, 2007 was $23.69.

111