DIRECTV 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

separate recognition, such as exploitable advertising space, assembled production and distribution

networks and assembled workforces.

The exchange ratio of LEI common stock to DIRECTV Group common stock was determined in

a manner such that LEI stockholders as a group received a premium in the form of a larger economic

interest in DIRECTV than would have been otherwise determined based on the relative fair values of

DIRECTV Group and LEI. This premium, calculated as the value of the economic interest in

DIRECTV distributed to LEI stockholders based on the fair value of the merged assets of DIRECTV

as of November 19, 2009, in excess of the acquisition date fair value of the assets and liabilities of LEI,

amounted to $337 million and has been expensed as a disproportionate distribution upon completion of

the mergers in ‘‘Liberty transaction and related charges’’ in the Consolidated Statements of Operations

for the year ended December 31, 2009.

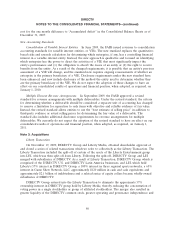

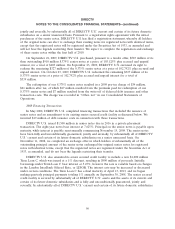

The premium was calculated as follows:

Former LEI shareholder interest in the fair value of the net assets of DIRECTV . . . $16,054

Less: Fair value of net assets contributed by LEI, including 57% interest in

DIRECTV Group ............................................... 15,717

Premium ....................................................... $ 337

As part of the mergers, DIRECTV assumed 16.7 million common stock options and stock

appreciation rights issued by LEI. Since many of the replacement awards are held by individuals who

remained employees of Liberty and did not become employees or directors of DIRECTV, they are

reported as a liability at fair value by DIRECTV in accordance with accounting standards for

non-employee awards. See Note 15 for additional information regarding these stock based awards.

Also, the assumed indebtedness includes related equity collars which were in a liability position

with an estimated negative fair value of approximately $369 million as of the acquisition date. We

account for the derivative financial instruments of the equity collars acquired as a net asset or liability

at fair value. Adjustments to the fair values of the stock based awards and the equity collars are

recorded in ‘‘Liberty transaction and related charges’’ in the Consolidated Statements of Operations.

See Note 9 for additional information regarding the indebtedness and equity collars.

For the year ended December 31, 2009, amounts charged to ‘‘Liberty transaction and related

charges’’ in the Consolidated Statements of Operations totaled $491 million, and include, the

$337 million premium, $111 million of net losses recorded for the partial settlement and fair value

adjustment of the equity collars and non-employee stock based awards from the acquisition date to

December 31, 2009 and the $43 million of acquisition related costs.

Cash paid, net of cash acquired in connection with the transaction was $97 million and includes a

$226 million repayment of LEI’s existing loan from Liberty at the close of the transaction and

$43 million of cash paid for transaction costs, partially offset by $120 million in cash at LEI, and

$56 million of cash at the regional sports networks.

We assigned $228 million to definite lived intangible assets of the regional sports networks for

affiliate and advertising relationships. The weighted average live of these intangibles is 19 years. These

intangibles are included in the Trade name and other component of ‘‘Intangible assets, net’’ in the

Consolidated balance sheets.

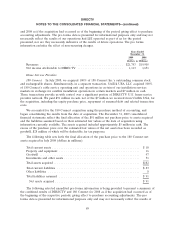

The following selected unaudited pro forma information is being provided to present a summary of

the combined results of DIRECTV and Liberty Entertainment for the years ended December 31, 2009

88