DIRECTV 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

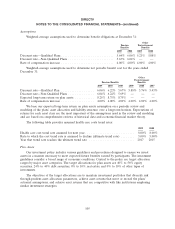

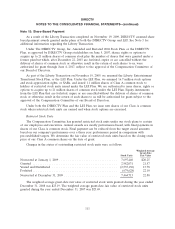

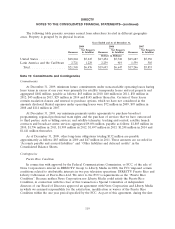

The following table presents amounts recorded related to share-based compensation:

For the Years Ended

December 31,

2009 2008 2007

(Dollars in Millions)

Share-based compensation expense recognized .......................... $ 55 $ 51 $ 49

Tax benefits associated with share-based compensation expense .............. 21 19 19

Actual tax benefits realized for the deduction of share-based compensation

expense .................................................... 42 43 36

Proceeds received from stock options exercised ......................... 144 105 118

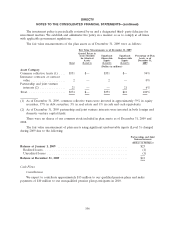

As of December 31, 2009, there was $62 million of total unrecognized compensation expense

related to unvested restricted stock units that we expect to recognize as follows: $40 million in 2010

and $22 million in 2011.

During 2009, we implemented a net exercise plan pursuant to which we only issue new shares in

connection with employee option exercises equal to the intrinsic value of the exercised award on the

exercise date reduced by the amount of statutory employee withholding taxes and divided by the

current market price of the our common stock. As a result, we no longer receive cash in connection

with the exercise of stock options, but rather issue significantly fewer shares. In addition, the company

is required to pay the employee withholding taxes to taxing authorities, the cash payments for which

are reported in ‘‘Taxes paid in lieu of shares issued for share-based compensation’’ in the Consolidated

Statements of Cash Flows.

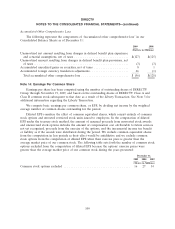

Note 16: Other Income and Expenses

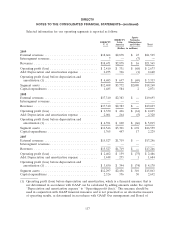

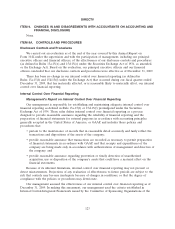

The following table summarizes the components of ‘‘Other, net’’ in our Consolidated Statements of

Operations for the years ended December 31:

2009 2008 2007

(Dollars in Millions)

Equity in earnings from unconsolidated affiliates .......................... $51 $55 $35

Net foreign currency transaction gain .................................. 62 — —

Loss from impairment of investments .................................. (45)

Loss on early extinguishment of debt .................................. (34) — —

Net gain (loss) from sale of investments ................................ — 1 (6)

Other ......................................................... — (1) (3)

Total other, net ................................................ $34 $55 $26

See Note 7 regarding equity method investments and net gains and losses recorded on the sale of

investments.

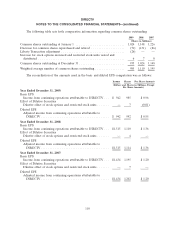

Note 17: Related-Party Transactions

In the ordinary course of our operations, we enter into transactions with related parties as

discussed below.

114