DIRECTV 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

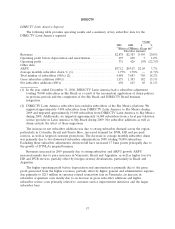

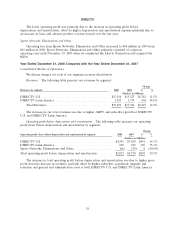

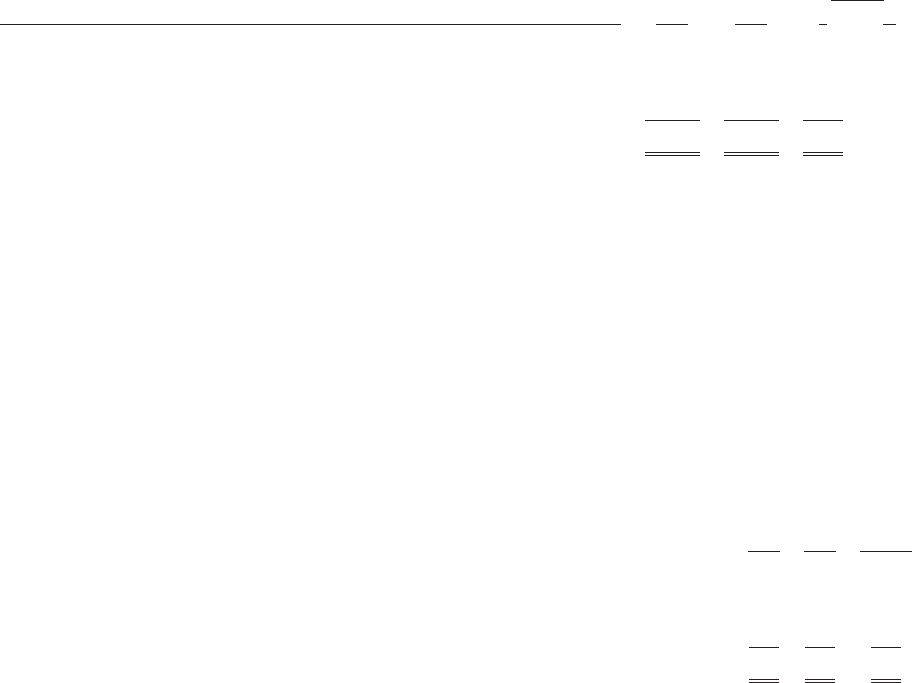

Operating profit. The following table presents our operating profit (loss) by segment:

Change

Operating profit (loss) by segment: 2008 2007 $ %

(Dollars in Millions)

DIRECTV U.S. ....................................... $2,330 $2,402 $(72) (3.0)%

DIRECTV Latin America ................................ 426 159 267 167.9%

Sports Networks, Eliminations and Other ..................... (61) (75) 14 (18.7)%

Total operating profit .................................... $2,695 $2,486 $209 8.4%

The increase in our operating profit was primarily due to increased operating profit before

depreciation and amortization, partially offset by the increase in depreciation and amortization expense

due to the DIRECTV U.S. lease program.

Interest income. The decrease in interest income to $81 million in 2008 from $111 million in 2007

was due to lower interest rates and lower average cash balances due mostly to the use of cash to fund

our share repurchase program.

Interest expense. The increase in interest expense from $235 million in 2007 to $360 million in

2008 was due to an increase in the average debt balance compared to 2007 and lower capitalization of

interest cost in 2008. We capitalized $18 million of interest costs in 2008 and $51 million in 2007. The

reduction in the capitalization of interest costs was due to the successful completion and launch of two

satellites.

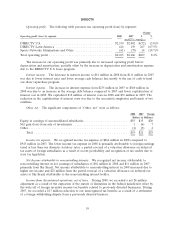

Other, net. The significant components of ‘‘Other, net’’ were as follows:

2008 2007 Change

(Dollars in Millions)

Equity in earnings of unconsolidated subsidiaries ........................ $55 $35 $20

Net gain (loss) from sale of investments ............................... 1 (6) 7

Other ........................................................ (1) (3) 2

Total ..................................................... $55 $26 $29

Income tax expense. We recognized income tax expense of $864 million in 2008 compared to

$943 million in 2007. The lower income tax expense in 2008 is primarily attributable to foreign earnings

taxed at less than our domestic statutory rates, a partial reversal of a valuation allowance on deferred

tax assets of foreign subsidiaries as a result of recent profitability and recognition of tax credits due to

state tax legislation.

Net Income attributable to noncontrolling interests. We recognized net income attributable to

noncontrolling interest in net earnings of subsidiaries of $92 million in 2008 and $11 million in 2007

primarily from Sky Brazil. Net income attributable to noncontrolling interest in 2008 increased due to

higher net income and $23 million from the partial reversal of a valuation allowance on deferred tax

assets at Sky Brazil attributable to the noncontrolling interest holder.

Income from discontinued operations, net of taxes. During 2008, we recorded a net $6 million

adjustment as a result of the expiration of the statute of limitations in the federal jurisdiction offset by

the write-off of foreign incentive income tax benefits related to previously divested businesses. During

2007, we recorded a $17 million reduction to our unrecognized tax benefits as a result of a settlement

of a foreign withholding dispute from a previously divested business.

59