DIRECTV 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

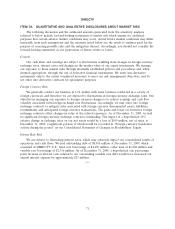

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31,

2009 2008 2007

(Dollars in Millions)

Cash Flows From Operating Activities

Net income ...................................................... $1,007 $ 1,613 $ 1,462

Income from discontinued operations, net of taxes ............................. — (6) (17)

Income from continuing operations ....................................... 1,007 1,607 1,445

Adjustments to reconcile income from continuing operations to net cash provided by operating

activities:

Depreciation and amortization ........................................ 2,640 2,320 1,684

Amortization of deferred revenues and deferred credits ........................ (48) (104) (98)

Dividends received ................................................ 94 35 —

Share-based compensation expense ..................................... 55 51 49

Net loss from impairment of investments .................................. 45 — —

Net foreign currency transaction gain .................................... (62) — —

Liberty transaction and related charges ................................... 491 — —

Deferred income taxes ............................................. 441 107 439

Other ........................................................ (3) (24) (15)

Change in operating assets and liabilities:

Accounts and notes receivable ....................................... (141) 95 (166)

Inventories ................................................... (12) 18 (45)

Prepaid expenses and other ......................................... (5) (96) 46

Accounts payable and accrued liabilities ................................. (215) (23) 255

Unearned subscriber revenues and deferred credits .......................... 55 8 72

Other, net .................................................... 89 (84) (21)

Net cash provided by operating activities ............................... 4,431 3,910 3,645

Cash Flows From Investing Activities

Cash paid for property and equipment ..................................... (2,012) (2,101) (2,523)

Cash paid for satellites .............................................. (59) (128) (169)

Cash paid for Liberty transaction, net of cash acquired .......................... (97) — —

Investment in companies, net of cash acquired ................................ (37) (204) (348)

Purchase of short-term investments ....................................... — — (588)

Sale of short-term investments .......................................... — — 748

Other, net ...................................................... 11 45 58

Net cash used in investing activities .................................. (2,194) (2,388) (2,822)

Cash Flows From Financing Activities

Cash proceeds from debt issuance ....................................... 1,990 2,490 —

Debt issuance costs ................................................. (14) (19) —

Repayment of long-term debt .......................................... (1,018) (53) (220)

Repayment of collar loan ............................................. (751) — —

Net increase in short-term borrowings ..................................... — — 2

Repayment of other long-term obligations .................................. (116) (117) (121)

Common shares repurchased and retired ................................... (1,696) (3,174) (2,025)

Capital contribution ................................................ — 160 —

Stock options exercised .............................................. 35 105 118

Taxes paid in lieu of shares issued for share-based compensation .................... (72) — —

Excess tax benefit from share-based compensation .............................587

Net cash used in financing activities .................................. (1,637) (600) (2,239)

Net increase (decrease) in cash and cash equivalents ............................. 600 922 (1,416)

Cash and cash equivalents at beginning of the year .............................. 2,005 1,083 2,499

Cash and cash equivalents at end of the year .................................. $2,605 $ 2,005 $ 1,083

Supplemental Cash Flow Information

Cash paid for interest ............................................... $ 412 $ 334 $ 230

Cash paid for income taxes ............................................ 484 706 408

The accompanying notes are an integral part of these Consolidated Financial Statements.

77