DIRECTV 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

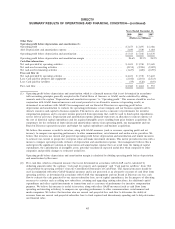

In 2010, we expect capital expenditures to approximate capital expenditures reported for 2009.

DIRECTV Latin America. In 2010, we expect revenue growth of roughly half of the growth

experienced in 2009. Although we anticipate net subscriber additions to be similar to 2009, this growth

will likely be partially offset by lower ARPU in the region caused by the recently announced

devaluation of the Venezuelan currency, discussed in more detail below under ‘‘Liquidity and Capital

Resources’’.

As a result of the anticipated growth in revenues and the economies of scale in Latin America, in

2010 we expect operating profit before depreciation and amortization growth of more than 20%.

In 2010, we expect capital expenditures in Latin America to exceed 2009 capital expenditures due

to anticipated higher gross subscriber additions and increased sales of advanced products.

DIRECTV. At the consolidated DIRECTV level, we anticipate free cash flow, or cash provided by

operating activities less capital expenditures, to grow in the mid-single digit percent range. The

improvements in operating profit before depreciation and amortization are expected to be partly offset

by an increase in cash paid for income taxes due to the anticipated increase in pre-tax earnings and the

cessation of benefits realized during the past two years associated with two Federal economic stimulus

programs in the U.S. as well as higher capital expenditures at DIRECTV Latin America and higher

expected interest expense.

2010 diluted earnings per common share is expected to more than double compared to 2009. The

expected increase in 2010 is due to the anticipated growth in operating profit before depreciation and

amortization, lower depreciation and amortization expense, and a continued decline in weighted

average common shares outstanding due to anticipated share repurchases.

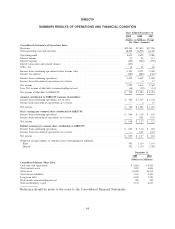

RESULTS OF OPERATIONS

Year Ended December 31, 2009 Compared with the Year Ended December 31, 2008

Consolidated Results of Operations

We discuss changes for each of our segments in more detail below.

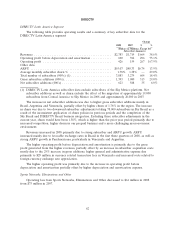

Revenues. The following table presents our revenues by segment:

Change

Revenues by segment: 2009 2008 $ %

(Dollars in Millions)

DIRECTV U.S. ..................................... $18,671 $17,310 $1,361 7.9%

DIRECTV Latin America .............................. 2,878 2,383 495 20.8%

Sports Networks, Eliminations and Other ................... 16 — 16 N/A

Total Revenues ..................................... $21,565 $19,693 $1,872 9.5%

The increase in our total revenues was due to subscriber growth and higher ARPU at DIRECTV

U.S. and DIRECTV Latin America.

52