DIRECTV 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

Directors use operating profit (loss) before depreciation and amortization to evaluate the

operating performance of our company and our business segments and to allocate resources and

capital to business segments. This metric is also used as a measure of performance for incentive

compensation purposes and to measure income generated from operations that could be used to

fund capital expenditures, service debt or pay taxes. Depreciation and amortization expense

primarily represents an allocation to current expense of the cost of historical capital expenditures

and for intangible assets resulting from prior business acquisitions. To compensate for the exclusion

of depreciation and amortization expense from operating profit, our management and our Board

of Directors separately measure and budget for capital expenditures and business acquisitions.

We believe this measure is useful to investors, along with GAAP measures (such as revenues,

operating profit and net income), to compare our operating performance to other communications,

entertainment and media service providers. We believe that investors use current and projected

operating profit (loss) before depreciation and amortization and similar measures to estimate our

current or prospective enterprise value and make investment decisions. This metric provides

investors with a means to compare operating results exclusive of depreciation and amortization.

Our management believes this is useful given the significant variation in depreciation and

amortization expense that can result from the timing of capital expenditures, the capitalization of

intangible assets, potential variations in expected useful lives when compared to other companies

and periodic changes to estimated useful lives.

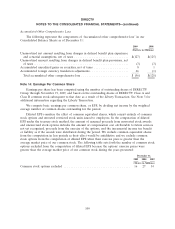

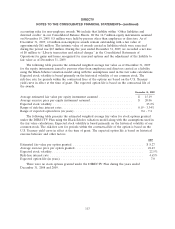

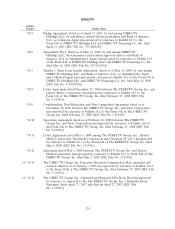

The following represents a reconciliation of operating profit before depreciation and amortization

to reported net income on the Consolidated Statements of Operations:

Years Ended December 31,

2009 2008 2007

(Dollars in Millions)

Operating profit before depreciation and amortization ............... $5,313 $ 5,015 $ 4,170

Depreciation and amortization expense .......................... (2,640) (2,320) (1,684)

Operating profit .......................................... 2,673 2,695 2,486

Interest income ........................................... 41 81 111

Interest expense .......................................... (423) (360) (235)

Liberty transaction and related charges .......................... (491) — —

Other, net ............................................... 34 55 26

Income from continuing operations before income taxes ............. 1,834 2,471 2,388

Income tax expense ........................................ (827) (864) (943)

Income from continuing operations ............................ 1,007 1,607 1,445

Income from discontinued operations, net of taxes ................. — 6 17

Net income .............................................. 1,007 1,613 1,462

Less: Net income attributable to noncontrolling interests ............. (65) (92) (11)

Net income attributable to DIRECTV .......................... $ 942 $1,521 $ 1,451

118