DIRECTV 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

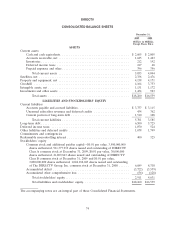

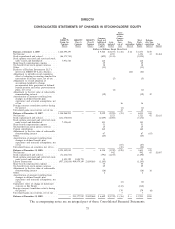

DIRECTV

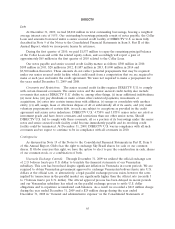

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

Accu-

mulated

Other

The Common Compre-

DIRECTV DIRECTV DIRECTV Stock and hensive Total Redeem-

Group, Inc. Class A Class B Additional Accu- Loss, Non- Stock- able Non-

Common Common Common Paid-In mulated net of controlling holders’ controlling Net

Shares Shares Shares Capital Deficit taxes Interest Equity Interest Income

(Dollars in Millions, Except Share Data)

Balance at January 1, 2007 .......... 1,226,490,193 $ 9,566 $(3,107) $ (48) $ 62 $ 6,473 $270

Net Income .................... 1,451 1,451 11 $1,462

Stock repurchased and retired ......... (86,173,710) (692) (1,333) (2,025)

Stock options exercised and restricted stock

units vested and distributed ......... 7,951,720 118 118

Share-based compensation expense ...... 49 49

Tax benefit from stock option exercises . . . 18 18

Other ........................ (11) (11)

Purchase of Darlene Investments LLC’s

interest in DIRECTV Latin America . . . (62) (62)

Adjustment to initially record cumulative

effect of adopting accounting standard for

uncertainty in income taxes, net of tax . . (5) (5)

Adjustment to record adoption of

accounting standard to change

measurement date provisions of defined

benefit pension and other postretirement

plans, net of tax ................ (1) (1)

Adjustment to the fair value of redeemable

noncontrolling interest ............ (19) (19) 19

Amortization of amounts resulting from

changes in defined benefit plan

experience and actuarial assumptions, net

of tax ...................... 16 16

Foreign currency translation activity during

the period ................... (1) (1)

Unrealized gains on securities, net of tax . . 12 12

Balance at December 31, 2007 ......... 1,148,268,203 — — 9,029 (2,995) (21) — 6,013 300

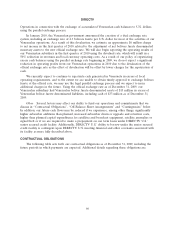

Net Income .................... 1,521 1,521 92 $1,613

Stock repurchased and retired ......... (131,476,804) (1,089) (2,085) (3,174)

Stock options exercised and restricted stock

units vested and distributed ......... 7,390,644 105 105

Share-based compensation expense ...... 51 51

Tax benefit from stock option exercises . . . 15 15

Capital contribution ............... 160 160

Adjustment to the fair value of redeemable

noncontrolling interest ............ 67 67 (67)

Other ........................ (20) (20)

Amortization of amounts resulting from

changes in defined benefit plan

experience and actuarial assumptions, net

of tax ...................... (87) (87)

Unrealized losses on securities, net of tax . . (20) (20)

Balance at December 31, 2008 ......... 1,024,182,043 — — 8,318 (3,559) (128) — 4,631 325

Net Income .................... 942 942 65 $1,007

Stock repurchased and retired ......... (71,242,534) (591) (1,105) (1,696)

Stock options exercised and restricted stock

units vested and distributed ......... 4,191,329 1,898,770 35 35

Liberty Transaction ............... (957,130,838) 909,479,149 21,809,863 (1,145) (1,145)

Share-based compensation expense ...... 55 55

Tax benefit from stock option exercises . . . 29 29

Adjustment to the fair value of redeemable

noncontrolling interest ............ (16) (16) 16

Other ........................ 4 4

Amortization of amounts resulting from

changes in defined benefit plan

experience and actuarial assumptions, net

of tax ...................... (2) (2)

Cumulative effect of change in functional

currency at Sky Brazil ............ (112) (112)

Foreign currency translation activity during

the period ................... 179 179 (6)

Unrealized gains on securities, net of tax . . 7 7

Balance at December 31, 2009 ......... — 911,377,919 21,809,863 $ 6,689 $(3,722) $ (56) $ — $ 2,911 $400

The accompanying notes are an integral part of these Consolidated Financial Statements.

75