DIRECTV 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

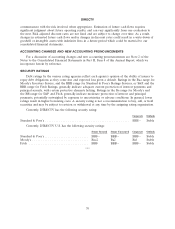

DIRECTV

provided in the Notes to the Consolidated Financial Statements in Part II, Item 8 referenced in the

table.

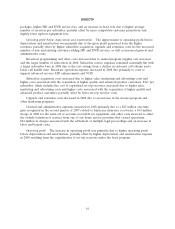

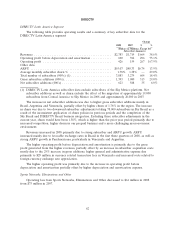

Payments Due By Period

Less than More than

Contractual Obligations Total 1 year 1-3 years 3-5 years 5 years

(Dollars in Millions)

Long-term debt obligations (Note 9) (a) ......... $ 9,102 $ 665 $ 830 $3,473 $4,134

Purchase obligations (Note 19) (b) ............. 9,696 1,805 3,705 2,745 1,441

Operating lease obligations (Note 19) (c) ........ 402 65 118 74 145

Capital lease obligations (Note 11) ............. 930 89 171 159 511

Other long-term liabilities reflected on the

Consolidated Balance Sheets under GAAP

(Note 19) (d) .......................... 140 91 49 — —

Total (e) ................................ $20,270 $2,715 $4,873 $6,451 $6,231

(a) Long-term debt obligations include interest calculated based on the rates in effect at December 31,

2009, however, the obligations do not reflect potential prepayments that may be required under

DIRECTV U.S.’ senior secured credit facility, if any, or permitted under its indentures.

(b) Purchase obligations consist primarily of broadcast programming commitments, regional

professional team rights agreements, service contract commitments and satellite launch contracts.

Broadcast programming commitments include guaranteed minimum contractual commitments that

are typically based on a flat fee or a minimum number of required subscribers subscribing to the

related programming. Actual payments may exceed the minimum payment requirements if the

actual number of subscribers subscribing to the related programming exceeds the minimum

amounts. Service contract commitments include minimum commitments for the purchase of

services that have been outsourced to third parties, such as billing services, telemetry, tracking and

control services and broadcast center services. In most cases, actual payments, which are typically

based on volume, usually exceed these minimum amounts.

(c) Certain of the operating leases contain escalation clauses and renewal or purchase options, which

we do not consider in the amounts disclosed.

(d) Payments due by period for other long-term liabilities reflected on the Consolidated Balance Sheet

under GAAP do not include payments that could be made related to our net unrecognized tax

benefits liability, which amounted to $367 million as of December 31, 2009. The timing and

amount of any future payments is not reasonably estimable, as such payments are dependent on

the completion and resolution of examinations with tax authorities. We do not expect a significant

payment related to these obligations within the next twelve months.

(e) Excluded from these obligations are the $1,202 million Collar Loan and the related $400 million

equity collars. During the first quarter of 2010, we paid the remaining principal balance of the loan

and settled the equity collars.

OFF-BALANCE SHEET ARRANGEMENTS

As of December 31, 2009, we were contingently liable under standby letters of credit and bonds in

the aggregate amount of $35 million primarily related to insurance deductibles.

67