DIRECTV 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

Sheets. These amounts secure our letter of credit obligations. Restrictions on the cash will be removed

as the letters of credit expire.

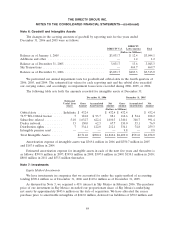

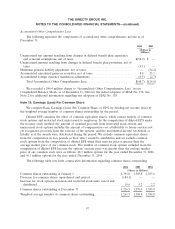

Note 10: Income Taxes

We base our income tax expense or benefit on reported ‘‘Income (Loss) From Continuing

Operations Before Income Taxes, Minority Interests and Cumulative Effect of Accounting Changes.’’

Deferred income tax assets and liabilities reflect the impact of temporary differences between the

amounts of assets and liabilities recognized for financial reporting purposes and such amounts

recognized for tax purposes, as measured by applying currently enacted tax laws.

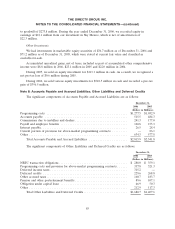

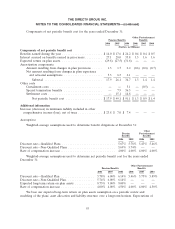

Our income tax (expense) benefit consisted of the following for the years ended December 31:

2006 2005 2004

(Dollars in Millions)

Current tax (expense) benefit:

U.S. federal ........................................... $ (20.0) $ 14.3 $(34.9)

Foreign .............................................. (16.3) 6.5 6.0

State and local ......................................... (32.1) (1.4) (4.6)

Total ............................................. (68.4) 19.4 (33.5)

Deferred tax (expense) benefit:

U.S. federal ........................................... (703.4) (170.1) 631.0

State and local ......................................... (93.7) (22.5) 93.1

Total ............................................. (797.1) (192.6) 724.1

Total income tax (expense) benefit ....................... $(865.5) $(173.2) $690.6

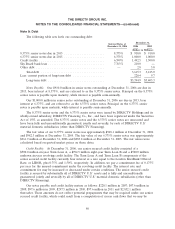

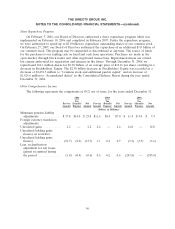

‘‘Income (Loss) From Continuing Operations Before Income Taxes, Minority Interests and

Cumulative Effect of Accounting Changes’’ included the following components for the years ended

December 31:

2006 2005 2004

(Dollars in Millions)

U.S. income (loss) ........................................ $2,161.3 $523.8 $(1,614.5)

Foreign income (loss) ..................................... 137.3 (43.5) (145.6)

Total .............................................. $2,298.6 $480.3 $(1,760.1)

88