DIRECTV 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

exercise of stock options or pay-out of restricted stock units as a cash flow from financing activities in

our Consolidated Statements of Cash Flows.

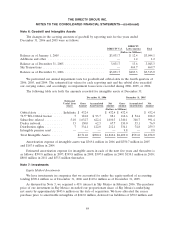

Subscriber Acquisition, Upgrade and Retention Costs. Effective January 1, 2004, DIRECTV U.S.

changed its method of accounting for subscriber acquisition, upgrade and retention costs. Previously, we

deferred a portion of these costs, equal to the amount of profit to be earned from the subscriber,

typically over the 12 month subscriber contract, and amortized to expense over the contract period. We

now expense subscriber acquisition, upgrade and retention costs as incurred as subscribers activate the

DIRECTV service. We determined that expensing such costs was preferable to the prior accounting

method after considering the accounting practices of competitors and companies within similar

industries and the added clarity and ease of understanding our reported results for investors. We

continue to capitalize set-top receivers provided under our lease programs. As a result of the change,

on January 1, 2004, we expensed our deferred subscriber acquisition cost balance, which amounted to

$503.9 million as of December 31, 2003 as a cumulative effect of accounting change. The amount of

the cumulative effect was $310.5 million, net of taxes.

Other. On January 1, 2006, we adopted SFAS No. 154, ‘‘Accounting Changes and Error

Corrections, a replacement of APB Opinion No. 20, Accounting Changes, and Statement No. 3,

Reporting Accounting Changes in Interim Financial Statements.’’. SFAS No. 154 changes the

requirements for the accounting for, and reporting of, a change in accounting principle. Previously,

most voluntary changes in accounting principles were required to be recognized by way of a cumulative

effect adjustment within net income during the period of the change. SFAS No. 154 generally requires

retrospective application to prior periods’ financial statements of voluntary changes in accounting

principles. The adoption of SFAS No. 154 on January 1, 2006 had no effect on our consolidated results

of operations or financial position.

New Accounting Standards

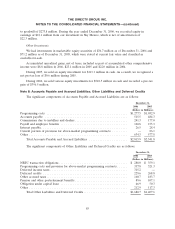

In February 2007, the Financial Accounting Standards Board, or FASB, issued SFAS No. 159, ‘‘The

Fair Value Option for Financial Assets and Financial Liabilities—Including an amendment of FASB

Statement No. 115.’’ SFAS No. 159 permits, but does not require, companies to report at fair value the

majority of recognized financial assets, financial liabilities and firm commitments. Under this standard,

unrealized gains and losses on items for which the fair value option is elected are reported in earnings

at each subsequent reporting date. We are currently assessing the effect SFAS No. 159 may have, if

any, to our consolidated results of operations or financial position when adopted on January 1, 2008.

In September 2006, the FASB issued SFAS No. 157, ‘‘Fair Value Measurements.’’ SFAS No. 157

defines fair value, sets out a framework for measuring fair value in generally accepted accounting

principles, and expands disclosures about fair value measurements of assets and liabilities. SFAS

No. 157 applies under other accounting pronouncements previously issued by the FASB that require or

permit fair value measurements. We do not expect the adoption of SFAS No. 157 on January 1, 2008 to

have any effect on our consolidated results of operations or financial position.

In September 2006, the Emerging Issues Task Force, or EITF, issued EITF No. 06-1, ‘‘Accounting

for Consideration Given by a Service Provider to a Manufacturer or Reseller of Equipment Necessary

for an End-Customer to Receive Service from the Service Provider.’’ EITF No. 06-1 provides guidance

to service providers regarding the proper reporting of consideration given to manufacturers or resellers

of equipment necessary for an end-customer to receive its services. Depending on the circumstances,

such consideration is reported as either an expense or a reduction of revenues. We are currently

75