DIRECTV 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

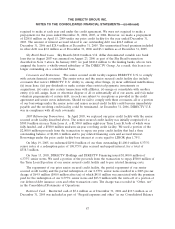

requirements, we earned a variable note receivable from Sky Mexico and we recorded a corresponding

gain of $70.4 million during the year ended December 31, 2005 in ‘‘(Gain) loss from disposition of

businesses and impairment charges, net’’ in our Consolidated Statements of Operations. At completion

of the transaction in February 2006, we recorded an additional gain of $57.0 million in ‘‘(Gain) loss

from disposition of businesses and impairment charges, net’’ in our Consolidated Statements of

Operations when DLA LLC received an equity interest in Sky Mexico resulting from the sale of

DIRECTV Mexico’s subscriber list and transfer of subscribers to Sky Mexico and cancellation of the

note receivable. Also in February 2006, we acquired News Corporation’s and Liberty’s equity interests

in Sky Mexico for $373.0 million in cash. On April 27, 2006, Televisa acquired a portion of our equity

interest in Sky Mexico at book value for $58.7 million in cash. As a result of these transactions, we

hold a 41% interest in Sky Mexico. We account for our investment in Sky Mexico using the equity

method of accounting. See Note 7 for additional information regarding this investment.

Other. In 2004, we acquired Sky Multi-Country Partners and related entities for $30.0 million in

cash. As part of this transaction, News Corporation agreed to reimburse us $127.0 million for the Sky

entities’ net liabilities we assumed, which we received from News Corporation in August 2006.

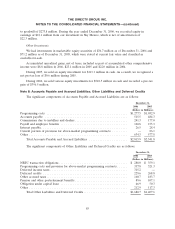

NRTC Contract Rights and Member Subscribers

Effective June 1, 2004, DIRECTV U.S. and the National Rural Telecommunications Cooperative,

or NRTC, agreed to end the NRTC’s exclusive DIRECTV service distribution agreement and all

related agreements. As consideration, DIRECTV U.S. agreed to pay the NRTC approximately

$4.4 million per month through June 2011, or $322.1 million on a present value basis, calculated using

an estimated incremental annual borrowing rate of 4.3%. As a result of this agreement, DIRECTV

U.S. has the right to sell its services in all territories across the United States. DIRECTV U.S. is

amortizing the distribution rights intangible asset of $334.1 million that was recorded as part of the

transaction, which includes the present value of the cash payments and fees associated with the

transactions to expense over seven years, which represented the remaining life of the terminated

DIRECTV service distribution agreement.

In connection with the NRTC transaction described above, during 2004, all NRTC members,

representing approximately 357,000 subscribers, excluding Pegasus Satellite Television, Inc., elected to

sell their subscribers to DIRECTV U.S. During 2004 we paid $187.2 million to members electing a

lump-sum payout plus additional fees associated with the transaction and recorded $198.3 million in

‘‘Accounts payable and accrued liabilities’’ and ‘‘Other Liabilities and Deferred Credits’’ for those

members electing the long-term payment option of seven years plus interest. As a result, DIRECTV

U.S. recorded a subscriber related intangible asset in ‘‘Intangible Assets, net’’ in our Consolidated

Balance Sheets amounting to $385.5 million, which is being amortized over the estimated subscriber

lives of approximately six years.

As of December 31, 2006, DIRECTV U.S. owes the NRTC and its members who elected the

long-term payment option $357.1 million, which is payable as follows: $71.0 million in 2007,

$75.3 million in 2008, $79.9 million in 2009, $83.3 million in 2010, and $47.6 million in 2011. These

amounts are recorded in ‘‘Accounts payable and accrued liabilities’’ and ‘‘Other Liabilities and Deferred

Credits’’ in our Consolidated Balance Sheets.

Pegasus Subscribers

On August 27, 2004, DIRECTV U.S. acquired the subscribers and certain assets, consisting

primarily of accounts receivable, of Pegasus for a total purchase price of $987.9 million. The total net

78