DIRECTV 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

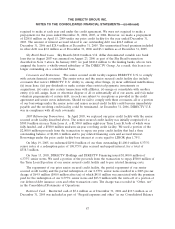

Share Repurchase Program

On February 7, 2006, our Board of Directors authorized a share repurchase program which was

implemented on February 10, 2006 and completed in February 2007. Under the repurchase program,

we were authorized to spend up to $3.0 billion to repurchase outstanding shares of our common stock.

On February 27, 2007, our Board of Directors authorized the repurchase of an additional $1.0 billion of

our common stock. This program may be suspended or discontinued at any time. The source of funds

for the purchases is our existing cash on hand and cash from operations. Purchases are made in the

open market, through block trades and other negotiated transactions. Repurchased shares are retired

but remain authorized for registration and issuance in the future. Through December 31, 2006, we

repurchased 184.1 million shares for $2.98 billion, at an average price of $16.16 per share, resulting in a

decrease in Stockholders’ Equity. The $2.98 billion decrease in Stockholders’ Equity was recorded as a

decrease of $1,452.5 million to ‘‘Common stock and additional paid in capital’’ and an increase of

$1,524.6 million to ‘‘Accumulated deficit’’ in the Consolidated Balance Sheets during the year ended

December 31, 2006.

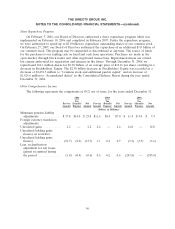

Other Comprehensive Income

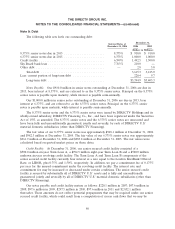

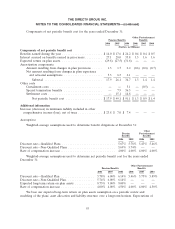

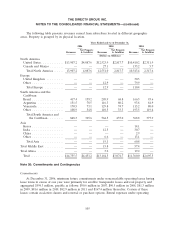

The following represents the components of OCI, net of taxes, for the years ended December 31:

2006 2005 2004

Tax Ta x Tax

Pre-tax (Benefit) Net Pre-tax (Benefit) Net Pre-tax (Benefit) Net

Amount Expense Amount Amount Expense Amount Amount Expense Amount

(Dollars in Millions)

Minimum pension liability

adjustments ............ $37.8 $14.0 $ 23.8 $11.4 $4.4 $7.0 $ 11.4 $ 4.0 $ 7.4

Foreign currency translation

adjustments:

Unrealized gains .......... 2.2 — 2.2 2.6 — 2.6 14.8 — 14.8

Unrealized holding gains

(losses) on securities:

Unrealized holding gains

(losses) ................ (21.7) (8.0) (13.7) 1.1 0.4 0.7 (9.1) (3.5) (5.6)

Less: reclassification

adjustment for net losses

(gains) recognized during

the period ............. (1.0) (0.4) (0.6) 0.6 0.2 0.4 (243.8) — (243.8)

96