DIRECTV 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

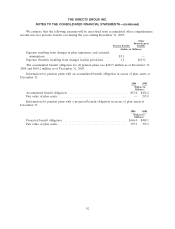

Other, including $36.2 million for retention benefits, $20.4 million for severance, and $56.4 million in

pension costs. At the Network Systems segment, we accrued $25.6 million in severance costs as a result

of the lay-offs following the announcement of the Thomson and SkyTerra transactions. At DTVLA, we

recorded $20.9 million in severance and retention charges, including $6.3 million related to the

shut-down of operations at DIRECTV Mexico, and headcount reductions following the emergence

from bankruptcy. All severance and retention benefits were paid to employees during 2005 and 2004.

We also recognized $23.0 million of pension special termination benefit and settlement costs at the

Corporate and Other segment in 2005 in ‘‘General and administrative expenses’’ in the Consolidated

Statements of Operations primarily related to the HNS transaction.

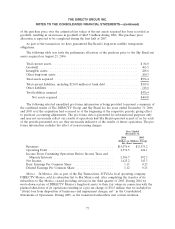

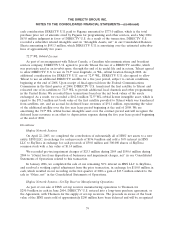

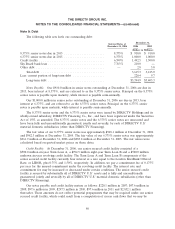

Note 4: (Gain) Loss on Disposition of Businesses and Impairment Charges

We recorded the following transactions in ‘‘(Gain) loss from disposition of businesses and

impairment charges, net’’ in our Consolidated Statement of Operations during the years ended

December 31:

2006 2005 2004

(Dollars in Millions)

Sky Brazil gain on sale of partial sale of GLB interest ........ $ (60.7) $ — $ —

DIRECTV Mexico gain on sale of subscriber list ............ (57.0) (70.4) —

DIRECTV Mexico impairment charge .................... — — 36.5

HNS—SkyTerra transaction impairment charge ............. — 25.3 190.6

SPACEWAY impairment charge ........................ — — 1,466.1

Total ......................................... $(117.7) $(45.1) $1,693.2

See Note 3 for further discussion of the Sky Brazil, DIRECTV Mexico and HNS-SkyTerra

transactions.

SPACEWAY Impairment Charge

In the third quarter of 2004, we decided to utilize certain of our SPACEWAY assets for DIRECTV

U.S. HD programming, which included two satellites, SPACEWAY 1 and SPACEWAY 2, that were

nearing completion, and related ground segment equipment and systems. Our decision to no longer use

these assets for the SPACEWAY broadband service triggered an impairment test of our investment in

the SPACEWAY assets. The SPACEWAY system was designed as a next-generation satellite-based

broadband data platform intended to upgrade and expand HNS’ broadband data businesses. Since the

book value of the SPACEWAY system had been supported by the expected cash flows from the

SPACEWAY broadband business plan that management no longer intended to pursue, the assets were

considered impaired. Further, a majority of the capitalized value of the SPACEWAY assets related to

functionality that will not be utilized for the DTH business. The impairment charge was determined by

comparing the fair value of the SPACEWAY assets to their book value as of September 30, 2004. The

fair value of the two satellites and certain related ground segment assets was determined based on the

fair value of those assets as configured to DIRECTV U.S.’ DTH business.

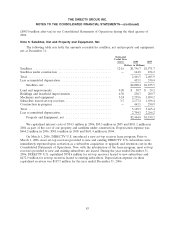

Based on the results of this analysis, we reduced the capitalized value of the SPACEWAY assets in

‘‘Satellites, net’’ by $1.099 billion to $305.0 million, and the capitalized value in ‘‘Property and

Equipment, net’’ by about $367 million to $30 million. These reductions were recorded as a

$1.466 billion pre-tax loss in ‘‘(Gain) loss from disposition of businesses and impairment charges, net’’

82