DIRECTV 2006 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

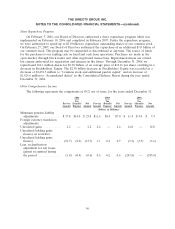

leases, net of sublease income, were $110.2 million in 2006, $108.8 million in 2005 and $180.5 million in

2004.

At December 31, 2006, our minimum payments under agreements to purchase broadcast

programming, and the purchase of services that we have outsourced to third parties, such as billing

services, and satellite telemetry, tracking and control and satellite construction and launch contracts

aggregated $4,613.0 million, payable as follows: $1,070.2 million in 2007, $920.9 million in 2008,

$982.3 million in 2009, $955.9 million in 2010, $546.3 million in 2011 and $137.4 million thereafter.

As of December 31, 2006, other long-term obligations totaling $480.6 million are payable

approximately as follows: $116.0 million in 2007, $80.6 million in 2008, $85.5 million in 2009,

$89.7 million in 2010, $54.6 million in 2011 and $54.2 million thereafter. These amounts are recorded

in ‘‘Accounts payable and accrued liabilities’’ and ‘‘Other Liabilities and Deferred Credits’’ in the

Consolidated Balance Sheets.

Contingencies

Litigation

Litigation is subject to uncertainties and the outcome of individual litigated matters is not

predictable with assurance. Various legal actions, claims and proceedings are pending against us arising

in the ordinary course of business. We have established loss provisions for matters in which losses are

probable and can be reasonably estimated. Some of the matters may involve compensatory, punitive, or

treble damage claims, or demands that, if granted, could require us to pay damages or make other

expenditures in amounts that could not be estimated at December 31, 2006. After discussion with

counsel representing us in those actions, it is the opinion of management that such litigation is not

expected to have a material adverse effect on our consolidated results of operations or financial

position.

Darlene Investments LLC. On October 18, 2004, Darlene filed suit in the circuit court for

Miami-Dade County, Florida, against The DIRECTV Group and certain of our subsidiaries, News

Corporation, and others, which we refer to collectively as the Defendants. The suit alleged fraud and

violation of fiduciary, contractual and other duties owed to Darlene and to DLA LLC by one or more

of the Defendants. Darlene sought injunctive relief to preclude DLA LLC from consummating the Sky

Transactions, $1 billion in damages and other relief. On November 3, 2005, the state court judge

dismissed certain charges, including fraud claims, for improper venue and entered an order essentially

staying the balance of the proceedings, including those related to fiduciary and other duties and those

brought against News Corporation, pending the arbitration between Darlene, DIRECTV and DLA

LLC.

In June 2005, we filed suit against Darlene in the United States District Court for the Southern

District of New York seeking specific performance and declaratory relief with respect to the release

agreement and covenant not to sue executed by Darlene in February 2004 in connection with the DLA

LLC reorganization and related transactions. On September 27, 2006, the District Court granted our

motion for summary judgment and found Darlene liable for breach of contract.

On January 30, 2007, we acquired Darlene’s 14% equity interest in DLA LLC for $325.0 million.

All pending litigation related to Darlene against us and the other parties described above has been

dismissed.

106