DIRECTV 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

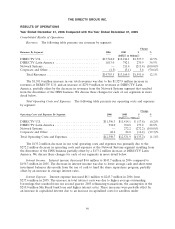

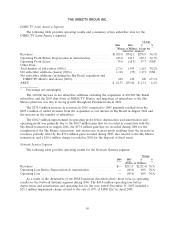

resulting from lower gross subscriber additions, and lower general and administrative costs. These

decreases were partially offset by higher broadcast programming and other costs, and higher subscriber

service, depreciation and amortization, and broadcast operations expenses. Operating costs and

expenses as a percentage of revenues decreased from approximately 93% in 2005 to 83% in 2006,

primarily due to the capitalization of set-top receivers under the lease program introduced on March 1,

2006, lower subscriber acquisition costs due to fewer gross subscriber additions and lower general and

administrative costs.

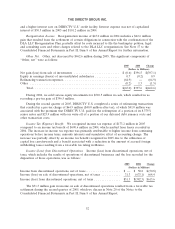

DIRECTV U.S.’ broadcast programming and other costs increased $780.3 million primarily from

the increased number of subscribers and annual program supplier rate increases. Subscriber service

expenses increased mostly from the larger subscriber base and an increase in service calls and costs

incurred at our call centers to support the increase in the number of subscribers with advanced

products. Broadcast operations expenses increased as a result of the costs to support new HD local

channel markets and launch of new advanced products.

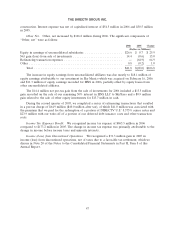

The $831.3 million decrease in subscriber acquisition costs was primarily due to the capitalization

of $598.6 million of set-top receivers under our new lease program and lower gross subscriber additions

in 2006. Including the cost of set-top receivers capitalized under our retention and upgrade programs,

upgrade and retention costs incurred increased by $218.1 million in 2006 due mostly to increased

volume under our HD and HD-DVR upgrade programs. This increase in upgrade and retention costs

incurred was offset by the capitalization of $472.9 million of leased set-top receivers in 2006, resulting

in a net decrease of $254.8 million compared to the prior year. The $42.0 million decrease in general

and administrative expenses resulted mainly from $122.6 million of lower bad debt expense, legal costs

and severance costs in 2006, partially offset by an increase in inventory management costs, property

taxes mostly associated with leased set-top receivers, and labor and employee benefit costs.

The increase in depreciation and amortization expense resulted mainly from the depreciation of

leased set-top receivers capitalized under the new lease program and higher depreciation resulting from

an increase in equipment purchased to support our broadcast operations.

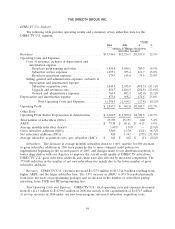

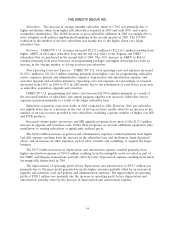

The improvement of operating profit before depreciation and amortization of $1,720.5 million was

primarily due to the gross profit generated from the higher revenues, the capitalization of

$1,071.5 million of set-top receivers under the lease program, fewer gross subscriber additions, and

lower general and administrative expenses, partially offset by an increase in upgrade and retention

costs. The increase in operating profit of $1,545.7 million was primarily due to higher operating profit

before depreciation and amortization, partially offset by the increase in depreciation and amortization

expense.

49