DIRECTV 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

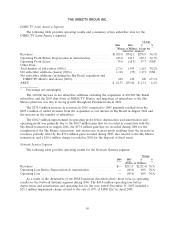

DIRECTV Latin America Segment

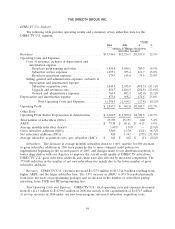

The following table provides operating results and a summary of key subscriber data for the

DIRECTV Latin America segment:

Change

2006 2005 $ %

(Dollars in Millions, Except Per

Subscriber Amounts)

Revenues ........................................... $1,013.0 $742.1 $270.9 36.5%

Operating Profit Before Depreciation & Amortization .......... 243.8 141.5 102.3 72.3%

Operating Profit (Loss) ................................. 79.0 (18.7) 97.7 NM*

Other Data:

Total number of subscribers (000’s) ........................ 2,711 1,593 1,118 70.2%

Net subscriber additions (losses) (000’s) ..................... 1,118 (53) 1,171 NM

Net subscriber additions (excluding the Sky Brazil acquisition and

DIRECTV Mexico shut-down) (000’s) .................... 249 149 100 67.1%

ARPU ............................................. $ 41.71 $39.20 $ 2.51 6.4%

* Percentage not meaningful

The 100,000 increase in net subscriber additions excluding the acquisition of 869,000 Sky Brazil

subscribers and the 2005 shut-down of DIRECTV Mexico and migration of subscribers to the Sky

Mexico platform, was due to strong growth throughout PanAmericana in 2006.

The $270.9 million increase in revenues in 2006 compared to 2005 primarily resulted from the

$205.2 million of added revenues from the acquisition of our interest in Sky Brazil in August 2006 and

the increase in the number of subscribers.

The $102.3 million improvement in operating profit before depreciation and amortization and

operating profit was primarily due to the $60.7 million gain that we recorded in connection with the

Sky Brazil transaction in August 2006, the $57.0 million gain that we recorded during 2006 for the

completion of the Sky Mexico transaction, and an increase in gross profit resulting from the increase in

revenues, partially offset by the $70.4 million gain recorded during 2005, also related to the Sky Mexico

transaction, and a $10.6 million charge recorded in 2006 for the disposal of fixed assets.

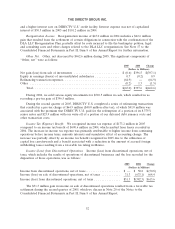

Network Systems Segment

The following table provides operating results for the Network Systems segment:

Change

2006 2005 $ %

(Dollars in Millions)

Revenues ............................................. $— $211.4 $(211.4) N/A

Operating Loss Before Depreciation & Amortization .............. — (60.8) 60.8 N/A

Operating Loss ......................................... — (60.8) 60.8 N/A

As a result of the divestitures of the HNS businesses described above, there were no operating

results for the Network Systems segment during 2006. The $60.8 million operating loss before

depreciation and amortization and operating loss for the year ended December 31, 2005 included a

$25.3 million impairment charge related to the sale of 50% of HNS LLC in April 2005.

50