DIRECTV 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

of the purchase price over the estimated fair values of the net assets acquired has been recorded as

goodwill, resulting in an increase in goodwill of $463.5 million during 2006. The purchase price

allocation is expected to be completed during the first half of 2007.

As part of the transaction, we have guaranteed Sky Brazil’s long-term satellite transponder

obligations.

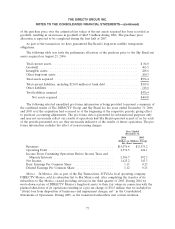

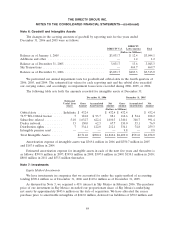

The following table sets forth the preliminary allocation of the purchase price to the Sky Brazil net

assets acquired on August 23, 2006:

Total current assets ................................................. $ 84.0

Goodwill ........................................................ 463.5

Intangible assets ................................................... 288.6

Other long-term assets .............................................. 100.3

Total assets acquired ................................................ $936.4

Total current liabilities, including $210.0 million of bank debt .................. $359.8

Other liabilities ................................................... 116.6

Total liabilities assumed ............................................. $476.4

Net assets acquired ............................................. $460.0

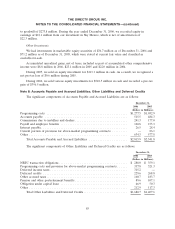

The following selected unaudited pro forma information is being provided to present a summary of

the combined results of The DIRECTV Group and Sky Brazil for the years ended December 31, 2006

and 2005 as if the acquisition had occurred as of the beginning of the respective periods, giving effect

to purchase accounting adjustments. The pro forma data is presented for informational purposes only

and may not necessarily reflect our results of operations had Sky Brazil operated as part of us for each

of the periods presented, nor are they necessarily indicative of the results of future operations. The pro

forma information excludes the effect of non-recurring charges.

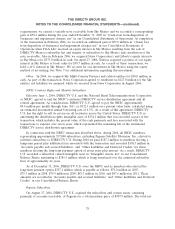

Years Ended

December 31,

2006 2005

(Dollars in Millions, Except

Per Share Amounts)

Revenues .......................................... $15,076.8 $13,535.2

Operating Profit ..................................... 2,374.5 624.1

Income From Continuing Operations Before Income Taxes and

Minority Interests .................................. 2,306.7 492.3

Net Income ........................................ 1,425.2 343.3

Basic Earnings Per Common Share ....................... 1.13 0.25

Diluted Earnings Per Common Share ..................... 1.12 0.25

Mexico. In Mexico, also as part of the Sky Transactions, DTVLA’s local operating company,

DIRECTV Mexico, sold its subscriber list to Sky Mexico and, after completing the transfer of its

subscribers to Sky Mexico, ceased providing services in the third quarter of 2005. During 2004 we

wrote-down certain of DIRECTV Mexico’s long-lived assets to their fair values in connection with the

planned shut-down of its operations resulting in a pre-tax charge of $36.5 million that we included in

‘‘(Gain) loss from disposition of businesses and impairment charges, net’’ in the Consolidated

Statements of Operations. During 2005, as the transferred subscribers met certain retention

77