DIRECTV 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

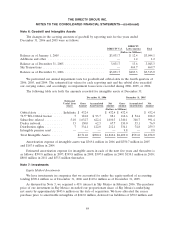

Accounting Changes

Defined Benefit Postretirement Plans. On December 31, 2006, we adopted certain provisions of

SFAS No. 158, ‘‘Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans—

an amendment of FASB Statements No. 87, 88, 106, and 132(R).’’ As a result, we now recognize the

funded status of our defined benefit postretirement plans in our Consolidated Balance Sheets.

Additionally, we will recognize changes in the funded status of our defined benefit postretirement plans

as a component of other comprehensive income, net of tax, in Stockholders’ Equity in the Consolidated

Balance Sheets, in the year in which the changes occur.

Additionally, SFAS No. 158 will require us to measure our plans’ assets and liabilities as of the end

of our fiscal year, which we expect to implement as of December 31, 2007.

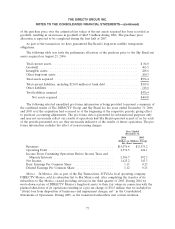

The adoption of the provisions of SFAS No. 158 to recognize the funded status of our benefit

plans had the following effect on our Consolidated Balance Sheet as of December 31, 2006:

Pension Benefits

Before Adoption After Adoption

of SFAS No. 158 Adjustment of SFAS No. 158

(Dollars in Millions)

Noncurrent benefit asset .......................... $44.3 $(44.3) $ —

Intangible asset ................................. 7.7 (7.7) —

Long-term deferred tax assets ...................... 6.5 27.8 34.3

Total assets .................................... $58.5 $(24.2) $ 34.3

Accounts payable and accrued liabilities ............... $(16.9) $ 7.1 $ (9.8)

Other long term liabilities and deferred credits .......... (36.1) (28.8) (64.9)

Total liabilities ................................. $(53.0) $(21.7) $(74.7)

Accumulated other comprehensive loss ................ $10.6 $ 45.9 $ 56.5

Other Postretirement Benefits

Before Adoption After Adoption

of SFAS No. 158 Adjustment of SFAS No. 158

(Dollars in Millions)

Long-term deferred tax assets ...................... $ — $0.3 $ 0.3

Accounts payable and accrued liabilities ............... $ (2.6) $(0.7) $ (3.3)

Other long term liabilities and deferred credits .......... (24.6) (0.1) (24.7)

Total liabilities ................................. $(27.2) $(0.8) $(28.0)

Accumulated other comprehensive loss ................ $ — $0.5 $ 0.5

Share-Based Payment. On January 1, 2006, we adopted SFAS No. 123R which replaces SFAS

No. 123, ‘‘Accounting for Stock-Based Compensation,’’ and supersedes Accounting Principles Board

Opinion No. 25, ‘‘Accounting for Stock Issued to Employees.’’ The adoption of this standard did not

have a significant effect on our consolidated results of operations or financial position, as the fair value

based calculation of compensation expense under SFAS No. 123R is substantially similar to the

calculation we applied under SFAS No. 123. However, as a result of the adoption of SFAS No. 123R,

beginning in the first quarter of 2006, we report the excess income tax benefit associated with the

74