DIRECTV 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

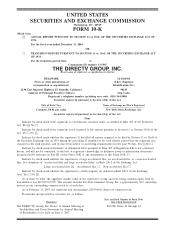

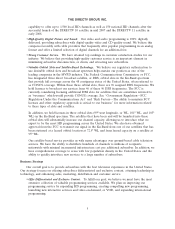

Financial Highlights

Years Ended December 31, 2006 2005 2004

(Dollars in Millions, Except Per Share Amounts)

Revenues $14,756 $13,165 $11,360

Operating profi t (loss)(1) $2,357 $633 $(2,119)

Depreciation and amortization expense 1,034 853 838

Operating profi t (loss) before

depreciation and amortization(1) (2) $3,391 $1,486 $(1,281)

Income (loss) from continuing operations

before cumulative effect of accounting changes $1,420 $305 $(1,056)

Income (loss) from discontinued operations,

net of taxes — 31 (582)

Cumulative effect of accounting

changes, net of taxes — — (311)

Net Income (loss) $1,420 $336 $(1,949)

Basic income (loss) per common share:

Income (loss) from continuing operations before

cumulative effect of accounting changes $1.13 $0.22 $(0.77)

Income (loss) from discontinued

operations, net of taxes — 0.02 (0.42)

Cumulative effect of accounting changes,

net of taxes — — (0.22)

Basic income (loss) per common share $1.13 $0.24 $(1.41)

Weighted average number of common

shares outstanding (in millions) 1,261.5 1,388.4 1,384.8

Cash paid for property, equipment and satellites $1,976 $889 $1,023

As of December 31, 2006 2005 2004

Cash and cash equivalents $2,499 $3,701 $2,307

Total current assets 4,556 6,096 4,771

Total assets 15,141 15,630 14,324

Total current liabilities 3,323 2,828 2,695

Total debt 3,615 3,415 2,429

Total stockholders’ equity 6,681 7,940 7,507

Number of employees (in thousands) 11 9 12

(1) The amount for the year ended December 31, 2004 includes $1,693 million of asset impairment charges, primarily related to the impairment

of the SPACEWAY assets, which is described in Note 4 to the Consolidated Financial Statements included in Item 8, Financial Statements and

Supplementary Data in The DIRECTV Group, Inc.’s Form 10-K for the year ended December 31, 2006, included in this Annual Report.

(2) Operating profi t (loss) before depreciation and amortization, which is a fi nancial measure that is not determined in accordance with accounting

principles generally accepted in the United States of America, or GAAP, can be calculated by adding amounts under the caption “Depreciation

and amortization expense” to “Operating profi t (loss).” This measure should be used in conjunction with GAAP fi nancial measures and is not

presented as an alternative measure of operating results, as determined in accordance with GAAP. For a further discussion of operating profi t

(loss) before depreciation and amortization, see Summary Data in Item 7, Management’s Discussion and Analysis of Financial Condition and

Results of Operations in The DIRECTV Group, Inc.’s Form 10-K for the year ended December 31, 2006, included in this Annual Report.

DIRECTV U.S. “Cash Flow before Interest and Taxes” of $1.4 billion as used in the following Message to Shareholders is calculated by deducting

amounts under the captions “Cash paid for property and equipment”, “Cash paid for subscriber leased equipment – subscriber acquisitions”,

“Cash paid for subscriber leased equipment – upgrade and retention”, “Cash paid for satellites” and “Interest income” from “Net cash provided by

operating activities” and adding back “Cash paid for interest” and “Income taxes paid” as disclosed in the Consolidated Statements of Cash Flows

and the Consolidated Statements of Operations found in the DIRECTV Holdings LLC Annual Report on Form 10-K for the year ended December 31,

2006 fi led with the SEC on March 1, 2007. A reconciliation of this non-GAAP measure to the nearest GAAP measure is provided at the back of this

Annual Report.

4 DIRECTV