DIRECTV 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

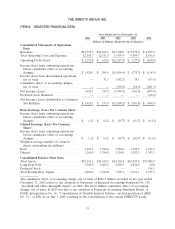

to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report for additional

information. In 2004, we recorded a $310.5 million charge in ‘‘Cumulative effect of accounting changes,

net of taxes’’.

Share Repurchase Program. On February 7, 2006, our Board of Directors authorized a $3.0 billion

share repurchase program. The sources of funds for the purchases were our available cash and cash

from operations. Through December 31, 2006, we repurchased and retired 184.1 million shares for

approximately $2.98 billion, at an average price of $16.16 per share. We completed the share

repurchase program in February 2007.

KEY TERMINOLOGY USED IN MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

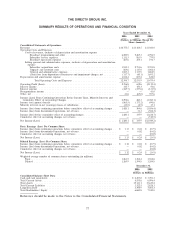

Revenues. We earn revenues mostly from monthly fees we charge subscribers for subscriptions to

basic and premium channel programming, pay-per-view programming, seasonal and live sporting events,

DVR and HD programming fees. We also earn revenues from monthly fees that we charge subscribers

with multiple non-leased set-top receivers (which we refer to as mirroring fees), monthly fees we charge

subscribers for leased set-top receivers, hardware revenues from subscribers who purchase set-top

receivers from us, our published programming guide, warranty service fees and advertising services.

Broadcast Programming and Other. These costs primarily include license fees for subscription

service programming, pay-per-view programming, live sports and other events. Other costs include

expenses associated with the publication and distribution of our programming guide, continuing service

fees paid to third parties for active subscribers, warranty service costs and production costs for on-air

advertisements we sell to third parties.

Subscriber Service Expenses. Subscriber service expenses include the costs of customer call centers,

billing, remittance processing and certain home services expenses, such as in-home repair costs.

Broadcast Operations Expenses. These expenses include broadcast center operating costs, signal

transmission expenses (including costs of collecting signals for our local channel offerings), and costs of

monitoring, maintaining and insuring our satellites. Also included are engineering expenses associated

with deterring theft of our signal.

Subscriber Acquisition Costs. These costs include the cost of set-top receivers and other

equipment, commissions we pay to national retailers, independent satellite television retailers, dealers,

RBOCs and the cost of installation, advertising, marketing and customer call center expenses associated

with the acquisition of new subscribers. Set-top receivers leased to new subscribers are capitalized in

‘‘Property and Equipment, net’’ in the Consolidated Balance Sheets and depreciated over their useful

lives. The amount of set-top receivers capitalized each period for subscriber acquisitions is included in

‘‘Cash paid for property and equipment’’ in the Consolidated Statements of Cash Flows.

Upgrade and Retention Costs. The majority of upgrade and retention costs are associated with

upgrade efforts for existing subscribers that we believe will result in higher ARPU and lower churn.

Our upgrade efforts include subscriber equipment upgrade programs for DVR, HD receivers and local

channels, our multiple set-top receiver offer and similar initiatives. Retention costs also include the

costs of installing and/or providing hardware under our movers program for subscribers relocating to a

new residence. Set-top receivers leased to existing subscribers under upgrade and retention programs

are capitalized in ‘‘Property and Equipment, net’’ in the Consolidated Balance Sheets and depreciated

over their useful lives. The amount of set-top receivers capitalized each period for upgrade and

43