DIRECTV 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

returns for each asset class are the most important of the assumptions used in the review and modeling

and are based on comprehensive reviews of historical data and economic/financial market theory.

A hypothetical 0.25% decrease in our discount rate would have had the effect of increasing our

2006 pension expense by approximately $0.9 million and our projected benefit obligation by

approximately $11.5 million. A hypothetical 0.25% decrease in our expected return on plan assets

would have had the effect of increasing our 2006 pension expense by $1.0 million.

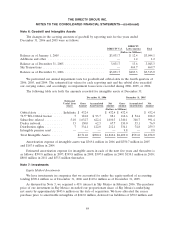

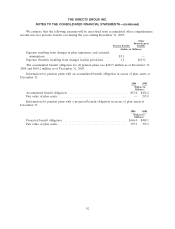

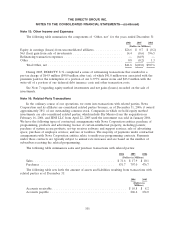

The following table provides assumed health care costs trend rates:

2006 2005

Health care cost trend rate assumed for next year ............................ 9.00% 10.00%

Rate to which the cost trend rate is assumed to decline (ultimate trend rate) ......... 5.00% 5.00%

Year that trend rate reaches the ultimate trend rate ........................... 2011 2011

A one-percentage-point change in assumed health care cost trend rates would have the following

effects:

1-Percentage 1-Percentage

Point Increase Point Decrease

(Dollars in Millions)

Effect on total of service and interest cost components ............... $0.1 $(0.1)

Effect on postretirement benefit obligation ....................... 1.7 (1.6)

Plan Assets

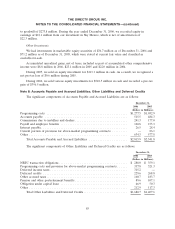

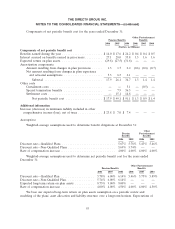

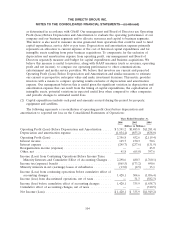

Our target asset allocation for 2007 and actual pension plan weighted average asset allocations at

December 31, 2006 and 2005, by asset categories, are as follows:

Percentage of

Target Plan Assets

Allocation at December 31,

2007 2006 2005

Equity securities .......................................... 50-70% 54% 54%

Debt securities ............................................ 30-50% 35% 35%

Real estate .............................................. 0-20% 5% 2%

Other .................................................. 0-20% 6% 9%

Total ................................................... 100% 100%

Our investment policy includes various guidelines and procedures designed to ensure we invest

assets in a manner necessary to meet expected future benefits earned by participants. The investment

guidelines consider a broad range of economic conditions. Central to the policy are target allocation

ranges (shown above) by major asset categories.

The objectives of the target allocations are to maintain investment portfolios that diversify risk

through prudent asset allocation parameters, achieve asset returns that meet or exceed the plans’

actuarial assumptions, and achieve asset returns that are competitive with like institutions employing

similar investment strategies.

94