DIRECTV 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

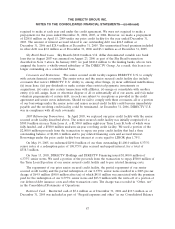

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

to goodwill of $273.8 million. During the year ended December 31, 2006, we recorded equity in

earnings of $18.1 million from our investment in Sky Mexico, which is net of amortization of

$22.3 million.

Other Investments

We had investments in marketable equity securities of $36.7 million as of December 31, 2006 and

$71.2 million as of December 31, 2005, which were stated at current fair value and classified as

available-for-sale.

Accumulated unrealized gains, net of taxes, included as part of accumulated other comprehensive

income were $8.8 million in 2006, $23.1 million in 2005 and $22.0 million in 2004.

During 2005, we sold an equity investment for $113.1 million in cash. As a result, we recognized a

net pre-tax loss of $0.6 million during 2005.

During 2004, we sold various equity investments for $510.5 million in cash and recorded a pre-tax

gain of $396.5 million.

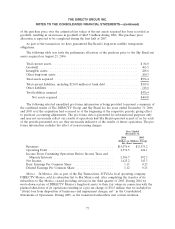

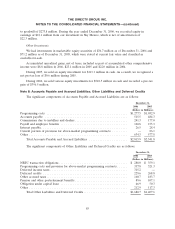

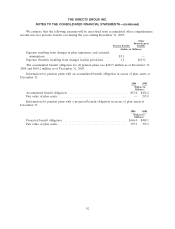

Note 8: Accounts Payable and Accrued Liabilities; Other Liabilities and Deferred Credits

The significant components of Accounts Payable and Accrued Liabilities are as follows:

December 31,

2006 2005

(Dollars in Millions)

Programming costs .............................................. $1,277.5 $1,032.9

Accounts payable ............................................... 515.5 484.3

Commissions due to installers and dealers .............................. 241.3 177.0

Payroll and employee benefits ...................................... 120.8 155.3

Interest payable ................................................. 26.5 28.4

Current portion of provision for above-market programming contracts ......... — 86.1

Other ........................................................ 634.3 577.8

Total Accounts Payable and Accrued Liabilities ...................... $2,815.9 $2,541.8

The significant components of Other Liabilities and Deferred Credits are as follows:

December 31,

2006 2005

(Dollars in Millions)

NRTC transaction obligations ....................................... $ 288.0 $ 359.1

Programming costs and provision for above-market programming contracts ...... 337.8 321.3

Deferred income taxes ............................................ 315.2 —

Deferred credits ................................................ 229.6 268.8

Other accrued taxes .............................................. 160.7 183.7

Pension and other postretirement benefits .............................. 89.6 107.1

Obligation under capital lease ...................................... 46.9 50.3

Other ........................................................ 212.9 117.3

Total Other Liabilities and Deferred Credits ......................... $1,680.7 $1,407.6

85