DIRECTV 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

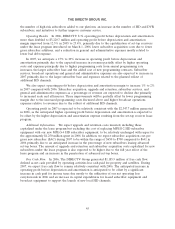

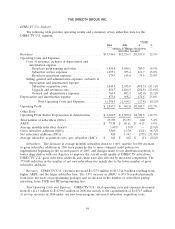

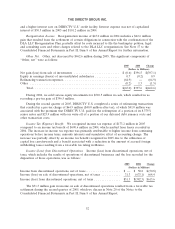

Subscribers. The increase in average monthly subscriber churn to 1.70% was primarily due to

higher involuntary churn from higher risk subscribers acquired in 2004 and early 2005, and a more

competitive marketplace. The 48,000 decrease in gross subscriber additions in 2005 was mainly due to

more stringent credit policies implemented beginning in the second quarter of 2005. The 535,000

reduction in the number of net new subscribers was mainly due to the higher churn on a larger

subscriber base.

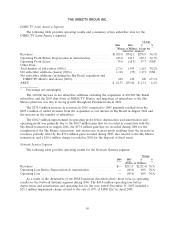

Revenues. DIRECTV U.S. revenues increased $2,452.2 million to $12,216.1 million resulting from

higher ARPU on the larger subscriber base and the full year effect of the Pegasus and NRTC

subscribers that we purchased in the second half of 2004. The 4.0% increase in ARPU to $69.61

resulted primarily from price increases on programming packages and higher mirroring fees from an

increase in the average number of set-top receivers per subscriber.

Total Operating Costs and Expenses. DIRECTV U.S. total operating costs and expenses increased

$1,672.1 million to $11,414.1 million resulting primarily from higher costs for programming, subscriber

service expenses, general and administrative expenses, depreciation and amortization expense, and

customer upgrade and retention initiatives. Operating costs and expenses as a percentage of revenues

decreased from 100% in 2004 to 93% in 2005 mostly due to the stabilization of costs in key areas such

as subscriber acquisition, upgrade and retention.

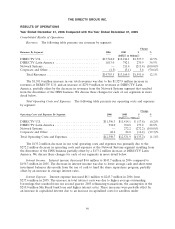

DIRECTV U.S. programming and other costs increased $1,039.6 million primarily as a result of

the increased number of subscribers and annual program supplier rate increases. Subscriber service

expenses increased primarily as a result of the larger subscriber base.

Subscriber acquisition costs were stable in 2005 compared to 2004. However, SAC per subscriber

was slightly lower due to a decrease in the cost of set-top receivers, mostly offset by an increase in the

number of set-top receivers provided to new subscribers, including a greater number of higher cost HD

and DVR products.

Increased volume under our movers and HD upgrade programs drove most of the $113.3 million

increase in upgrade and retention costs. Under these programs, we provide additional equipment, plus

installation, to existing subscribers at significantly reduced prices.

The $140.0 million increase in general and administrative expenses resulted primarily from higher

bad debt expense resulting from the increase in the subscriber base and involuntary churn discussed

above, and an increase in other expenses, such as labor, benefits and consulting, to support the larger

business.

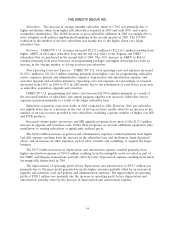

The $137.0 million increase in depreciation and amortization expense resulted primarily from

higher amortization expense of $181.0 million resulting from the intangible assets recorded as part of

the NRTC and Pegasus transactions, partially offset by lower depreciation expense resulting from assets

becoming fully depreciated in 2005.

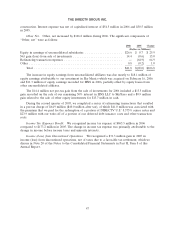

The improvement of operating profit before depreciation and amortization of $917.1 million was

primarily due to the gross profit generated from the higher revenues partially offset by an increase in

upgrade and retention costs and general and administration expenses. The improvement in operating

profit of $780.1 million was primarily due the increase in operating profit before depreciation and

amortization, partially offset by the increase in depreciation and amortization expense.

54