DIRECTV 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

Corporate and Other

Operating loss from Corporate and Other decreased to $69.9 million in 2006 from $89.9 million in

2005. The $20.0 million decrease was primarily due to higher pension expense in 2005 related to the

divestitures described above, partially offset by higher legal expenses and benefit costs in 2006.

Year Ended December 31, 2005 Compared with the Year Ended December 31, 2004

Consolidated Results of Operations

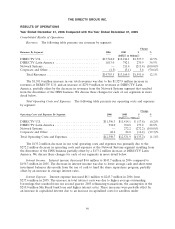

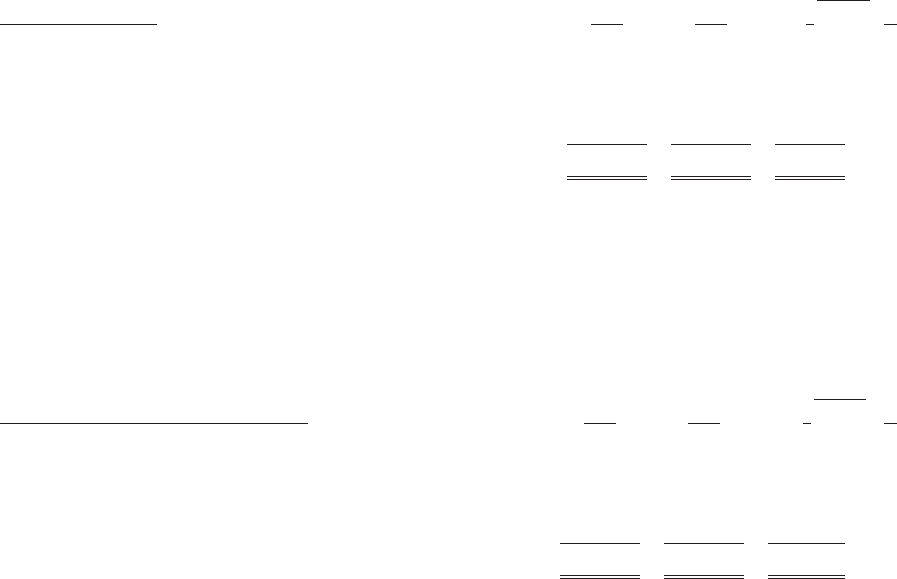

Revenues. The following table presents our revenues by segment:

Change

Revenues By Segment: 2005 2004 $ %

(Dollars in Millions)

DIRECTV U.S. ................................. $12,216.1 $ 9,763.9 $2,452.2 25.1%

DIRECTV Latin America .......................... 742.1 675.2 66.9 9.9%

Network Systems ................................. 211.4 1,099.1 (887.7) (80.8)%

Corporate and Other .............................. (5.1) (178.2) 173.1 (97.1)%

Total Revenues ............................... $13,164.5 $11,360.0 $1,804.5 15.9%

The increase in our total revenues was primarily due to the $2,452.2 million increase in revenues at

the DIRECTV U.S. segment, partially offset by the decrease in revenues from the Network Systems

segment resulting from the divestitures of the HNS businesses in 2005 and 2004. We discuss these

changes for each of our segments in more detail below.

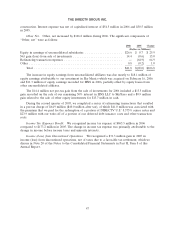

Total Operating Costs and Expenses. The following table presents our operating costs and expenses

by segment:

Change

Operating Costs and Expenses By Segment: 2005 2004 $ %

(Dollars in Millions)

DIRECTV U.S. ................................. $11,414.1 $ 9,742.0 $ 1,672.1 17.2%

DIRECTV Latin America ......................... 760.8 817.2 (56.4) (6.9)%

Network Systems ................................ 272.2 2,877.6 (2,605.4) (90.5)%

Corporate and Other ............................. 84.8 42.6 42.2 99.1%

Total Operating Costs and Expenses .................. $12,531.9 $13,479.4 $ (947.5) (7.0)%

The decrease in our total operating costs and expenses was primarily due to the $2,605.4 million

decrease in operating costs and expenses at the Network Systems segment, partially offset by the

$1,672.1 million increase at the DIRECTV U.S. segment. We discuss these changes for each of our

segments in more detail below.

Interest Income. Interest income increased to $150.3 million in 2005 compared to $50.6 million in

2004. The increase in interest income was due to an increase in average interest rates on higher

average cash balances and short-term investments.

Interest Expense. Interest expense increased to $237.6 million in 2005 from $131.9 million in 2004.

The increase in interest expense resulted primarily from the decrease in capitalized interest due to the

completion of the construction of the SPACEWAY satellites, an increase in our outstanding borrowings

51