DIRECTV 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

construction. Interest expense was net of capitalized interest of $54.5 million in 2006 and $30.5 million

in 2005.

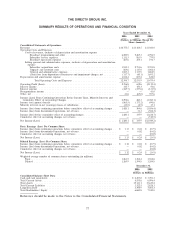

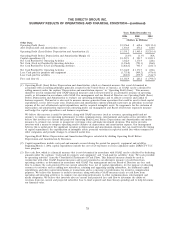

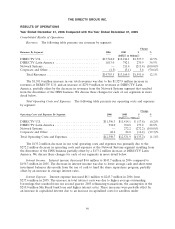

Other, Net. Other, net increased by $106.8 million during 2006. The significant components of

‘‘Other, net’’ were as follows:

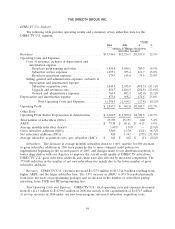

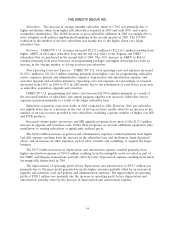

2006 2005 Change

(Dollars in Millions)

Equity in earnings of unconsolidated subsidiaries ..................... $26.6 $ 0.7 $ 25.9

Net gain (loss) from sale of investments ............................ 14.4 (0.6) 15.0

Refinancing transaction expenses ................................. — (64.9) 64.9

Other ..................................................... 0.8 (0.2) 1.0

Total .................................................. $41.8 $(65.0) $106.8

The increase in equity earnings from unconsolidated affiliates was due mostly to $18.1 million of

equity earnings attributable to our investment in Sky Mexico which was acquired on February 16, 2006

and $11.3 million of equity earnings recorded for HNS in 2006, partially offset by equity losses from

other unconsolidated affiliates.

The $14.4 million net pre-tax gain from the sale of investments for 2006 included a $13.5 million

gain recorded on the sale of our remaining 50% interest in HNS LLC to SkyTerra and a $0.9 million

gain related to the sale of other equity investments for $13.7 million in cash.

During the second quarter of 2005, we completed a series of refinancing transactions that resulted

in a pre-tax charge of $64.9 million ($40.0 million after tax), of which $41.0 million was associated with

the premium that we paid for the redemption of a portion of DIRECTV U.S.’ 8.375% senior notes and

$23.9 million with our write-off of a portion of our deferred debt issuance costs and other transaction

costs.

Income Tax (Expense) Benefit. We recognized income tax expense of $865.5 million in 2006

compared to $173.2 million in 2005. The change in income tax expense was primarily attributable to the

change in income before income taxes and minority interests.

Income (Loss) from Discontinued Operations. We recognized a $31.3 million gain in 2005 in

income (loss) from discontinued operations, net of taxes due to a favorable tax settlement, which we

discuss in Note 20 of the Notes to the Consolidated Financial Statements in Part II, Item 8 of this

Annual Report.

47