DIRECTV 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

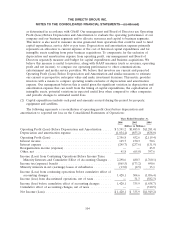

as determined in accordance with GAAP. Our management and Board of Directors use Operating

Profit (Loss) Before Depreciation and Amortization to evaluate the operating performance of our

company and our business segments and to allocate resources and capital to business segments.

This metric is also used to measure income generated from operations that could be used to fund

capital expenditures, service debt or pay taxes. Depreciation and amortization expense primarily

represents an allocation to current expense of the cost of historical capital expenditures and for

intangible assets resulting from prior business acquisitions. To compensate for the exclusion of

depreciation and amortization expense from operating profit, our management and Board of

Directors separately measure and budget for capital expenditures and business acquisitions. We

believe this measure is useful to investors, along with GAAP measures (such as revenues, operating

profit and net income), to compare our operating performance to other communications,

entertainment and media service providers. We believe that investors use current and projected

Operating Profit (Loss) Before Depreciation and Amortization and similar measures to estimate

our current or prospective enterprise value and make investment decisions. This metric provides

investors with a means to compare operating results exclusive of depreciation and amortization

expense. Our management believes this is useful given the significant variation in depreciation and

amortization expense that can result from the timing of capital expenditures, the capitalization of

intangible assets, potential variations in expected useful lives when compared to other companies

and periodic changes to estimated useful lives.

(2) Capital expenditures include cash paid and amounts accrued during the period for property,

equipment and satellites.

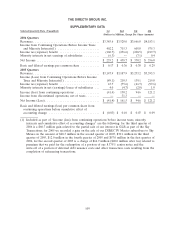

The following represents a reconciliation of operating profit (loss) before depreciation and

amortization to reported net loss on the Consolidated Statements of Operations:

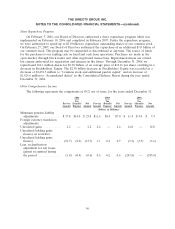

Years Ended December 31,

2006 2005 2004

(Dollars in Millions)

Operating Profit (Loss) Before Depreciation and Amortization ..... $3,391.2 $1,485.8 $(1,281.4)

Depreciation and amortization expense ...................... (1,034.4) (853.2) (838.0)

Operating Profit (Loss) .................................. 2,356.8 632.6 (2,119.4)

Interest income ........................................ 145.7 150.3 50.6

Interest expense ....................................... (245.7) (237.6) (131.9)

Reorganization income (expense) ........................... — — 43.0

Other, net ........................................... 41.8 (65.0) 397.6

Income (Loss) from Continuing Operations Before Income Taxes,

Minority Interests and Cumulative Effect of Accounting Changes . . 2,298.6 480.3 (1,760.1)

Income tax (expense) benefit .............................. (865.5) (173.2) 690.6

Minority interests in net (earnings) losses of subsidiaries .......... (13.0) (2.5) 13.1

Income (Loss) from continuing operations before cumulative effect of

accounting changes ................................... 1,420.1 304.6 (1,056.4)

Income (loss) from discontinued operations, net of taxes .......... — 31.3 (582.3)

Income (loss) before cumulative effect of accounting changes ...... 1,420.1 335.9 (1,638.7)

Cumulative effect of accounting changes, net of taxes ............ — — (310.5)

Net Income (Loss) ..................................... $1,420.1 $ 335.9 $(1,949.2)

104