DIRECTV 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

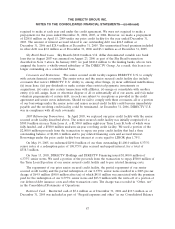

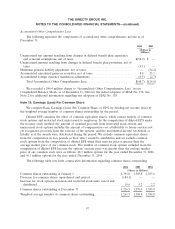

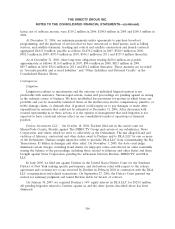

Accumulated Other Comprehensive Loss

The following represent the components of accumulated other comprehensive income as of

December 31:

2006 2005

(Dollars in

Millions)

Unamortized net amount resulting from changes in defined benefit plan experience

and actuarial assumptions, net of taxes ................................. $(52.9) $ —

Unamortized amount resulting from changes in defined benefit plan provisions, net of

taxes .......................................................... (4.1) —

Minimum pension liability adjustment, net of taxes .......................... — (34.4)

Accumulated unrealized gains on securities, net of taxes ...................... 8.8 23.1

Accumulated foreign currency translation adjustments ........................ (0.5) (2.7)

Total Accumulated Other Comprehensive Loss .......................... $(48.7) $(14.0)

We recorded a $46.4 million charge to ‘‘Accumulated Other Comprehensive Loss’’ in our

Consolidated Balance Sheets as of December 31, 2006 for the initial adoption of SFAS No. 158. See

Note 2 for additional information regarding our adoption of SFAS No. 158.

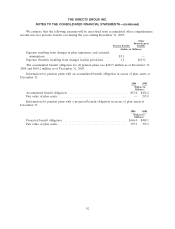

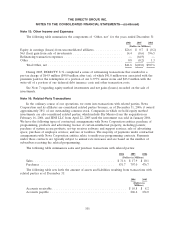

Note 13: Earnings (Loss) Per Common Share

We compute Basic Earnings (Loss) Per Common Share, or EPS, by dividing net income (loss) by

the weighted average number of common shares outstanding for the period.

Diluted EPS considers the effect of common equivalent shares, which consist entirely of common

stock options and restricted stock units issued to employees. In the computation of diluted EPS under

the treasury stock method, the amount of assumed proceeds from nonvested stock awards and

unexercised stock options includes the amount of compensation cost attributable to future services not

yet recognized, proceeds from the exercise of the options, and the incremental income tax benefit or

liability as if the awards were distributed during the period. We exclude common equivalent shares

from the computation in loss periods as their effect would be antidilutive and we exclude common

stock options from the computation of diluted EPS when their exercise price is greater than the

average market price of our common stock. The number of common stock options excluded from the

computation of diluted EPS because the options’ exercise price was greater than the average market

price of our common stock were as follows: 48.3 million options for the year ended December 31, 2006,

and 66.1 million options for the year ended December 31, 2005.

The following table sets forth comparative information regarding common shares outstanding:

2006 2005 2004

(Shares in Millions)

Common shares outstanding at January 1 ......................... 1,391.0 1,385.8 1,383.6

Decrease for common shares repurchased and retired ................ (184.1) — —

Increase for stock options exercised and restricted stock units vested and

distributed ............................................. 19.6 5.2 2.2

Common shares outstanding at December 31 ...................... 1,226.5 1,391.0 1,385.8

Weighted average number of common shares outstanding ............. 1,261.5 1,388.4 1,384.8

97