DIRECTV 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

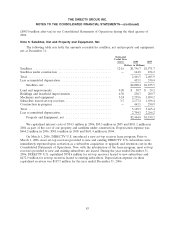

Note 6: Goodwill and Intangible Assets

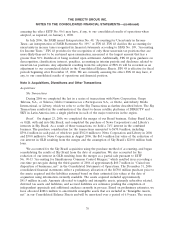

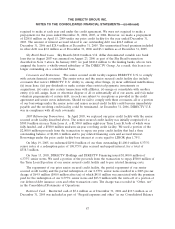

The changes in the carrying amounts of goodwill by reporting unit for the years ended

December 31, 2006 and 2005 were as follows:

DIRECTV

DIRECTV U.S. Latin America Total

(Dollars in Millions)

Balance as of January 1, 2005 ......................... $3,031.7 $ 12.4 $3,044.1

Additions and other ................................ — 1.2 1.2

Balance as of December 31, 2005 ...................... 3,031.7 13.6 3,045.3

Sky Transactions ................................... — 469.7 469.7

Balance as of December 31, 2006 ...................... $3,031.7 $483.3 $3,515.0

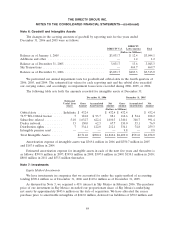

We performed our annual impairment tests for goodwill and orbital slots in the fourth quarters of

2006, 2005, and 2004. The estimated fair values for each reporting unit and the orbital slots exceeded

our carrying values, and accordingly, no impairment losses were recorded during 2006, 2005, or 2004.

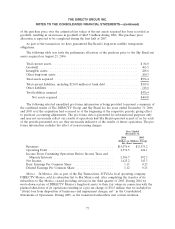

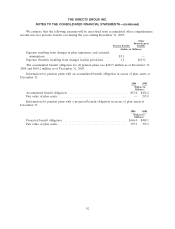

The following table sets forth the amounts recorded for intangible assets at December 31:

December 31, 2006 December 31, 2005

Estimated

Useful Lives Gross Accumulated Net Gross Accumulated Net

(years) Amount Amortization Amount Amount Amortization Amount

(Dollars in Millions)

Orbital slots .............. Indefinite $ 432.4 $ 432.4 $ 432.4 $ 432.4

72.5 WL Orbital license ..... 5 181.8 $ 93.7 88.1 162.6 $ 54.4 108.2

Subscriber related .......... 5-10 1,632.7 622.4 1,010.3 1,340.1 348.7 991.4

Dealer network ............ 15 130.0 62.3 67.7 130.0 53.1 76.9

Distribution rights .......... 7 334.1 122.0 212.1 334.1 74.8 259.3

Intangible pension asset ...... — — — — 9.8 — 9.8

Total Intangible Assets ....... $2,711.0 $900.4 $1,810.6 $2,409.0 $531.0 $1,878.0

Amortization expense of intangible assets was $369.4 million in 2006 and $350.7 million in 2005

and $167.6 million in 2004.

Estimated amortization expense for intangible assets in each of the next five years and thereafter is

as follows: $399.8 million in 2007; $399.8 million in 2008; $307.0 million in 2009; $138.1 million in 2010;

$80.0 million in 2011 and $53.5 million thereafter.

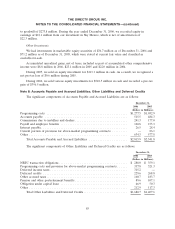

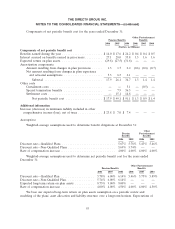

Note 7: Investments

Equity Method Investments

We have investments in companies that we accounted for under the equity method of accounting

totaling $509.6 million as of December 31, 2006 and $110.6 million as of December 31, 2005.

As discussed in Note 3, we acquired a 41% interest in Sky Mexico in February 2006. The purchase

price of our investment in Sky Mexico exceeded our proportionate share of Sky Mexico’s underlying

net assets by approximately $445.6 million on the date of acquisition. We have allocated the excess

purchase price to amortizable intangibles of $242.0 million, deferred tax liabilities of $70.2 million and

84