DIRECTV 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

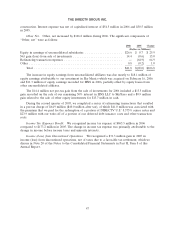

recording of a subscriber related intangible asset of $951.3 million from the Pegasus transaction that we

are amortizing over the estimated average subscriber lives of five years, and a subscriber related

intangible asset of $385.5 million that resulted from the NRTC transaction that we are amortizing over

the estimated average subscriber lives of six years. Had the estimated average subscriber lives for these

intangible assets been decreased by one year, annual amortization expense would have increased by

approximately $60 million.

Effective June 1, 2004, DIRECTV U.S. and the NRTC agreed to end the NRTC’s exclusive

DIRECTV service distribution agreement and all related agreements. As consideration, we agreed to

pay the NRTC approximately $4.4 million per month through June 2011. As a result of this agreement,

we have the right to sell the DIRECTV service in all territories across the United States. We are

amortizing the distribution rights intangible asset of $334.1 million that was recorded as part of the

transaction, which includes the present value of the cash payments and fees associated with the

transaction, to expense over the remaining life of the terminated service distribution agreement of

seven years.

Divestitures

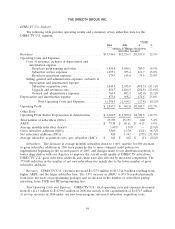

HNS—SkyTerra. On April 22, 2005, we completed the sale of a 50% interest in Hughes Network

Systems LLC, or HNS LLC, which owned substantially all of the net assets formerly held by HNS, to

SkyTerra Communications, Inc. We received total proceeds of $257.4 million, including cash of

$246.0 million, and 300,000 shares of SkyTerra common stock with a fair value of $11.4 million. As a

result of this transaction, we recorded pre-tax impairment charges of $25.3 million during the year

ended December 31, 2005 and $190.6 million during the year ended December 31, 2004 to ‘‘(Gain) loss

from disposition of businesses and impairment charges, net’’ in our Consolidated Statements of

Operations to reduce the carrying value of HNS’ assets to fair value. In January 2006, we completed

the sale of our remaining 50% interest in HNS LLC to SkyTerra. In exchange for our remaining 50%

interest and resolution of a final closing adjustment from the April 22, 2005 transaction, we received

cash proceeds of $110.0 million. During the year ended December 31, 2006 we recorded a net gain of

$13.5 million related to the sale to ‘‘Other, net’’ in the Consolidated Statements of Operations.

SPACEWAY. In the third quarter of 2004, we decided to utilize the SPACEWAY 1 and 2

satellites, and certain related assets, for DIRECTV U.S. HD programming. Our decision to no longer

use these assets for HNS’ SPACEWAY broadband service triggered an impairment test of our

investment in the SPACEWAY assets. As a result of this test, we determined that the book value of the

SPACEWAY satellites and ground segment equipment for their alternative use exceeded their fair value

by $1.47 billion. Accordingly, we recorded an impairment charge in ‘‘(Gain) loss from disposition of

businesses and impairment charges, net’’ in our Consolidated Statements of Operations during the year

ended December 31, 2004.

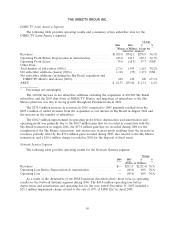

PanAmSat. On August 20, 2004, we completed the sale of our approximate 80.4% interest in

PanAmSat for about $2.64 billion in cash. As a result of this transaction, we recorded a loss of

$723.7 million, net of taxes, in ‘‘Income (loss) from discontinued operations, net of taxes’’ in our

Consolidated Statements of Operations during 2004.

HNS—HSS. In 2004, HNS completed the sale of its approximate 55% ownership interest in

Hughes Software Systems Limited, or HSS, for $226.5 million in cash, which we received in June 2004.

As a result of this transaction, we recognized a gain of $90.7 million, net of taxes, during 2004 in

‘‘Income (loss) from discontinued operations, net of taxes’’ in our Consolidated Statements of

Operations.

41