DIRECTV 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

assessing the effect EITF No. 06-1 may have, if any, to our consolidated results of operations when

adopted, as required, on January 1, 2008.

In July 2006, the FASB issued Interpretation No. 48, ‘‘Accounting for Uncertainty in Income

Taxes—an interpretation of FASB Statement No. 109,’’ or FIN 48. FIN 48 clarifies the accounting for

uncertainty in income taxes recognized in financial statements according to SFAS No. 109, ‘‘Accounting

for Income Taxes.’’ FIN 48 provides for the recognition of only those uncertain tax positions that are

more-likely-than-not to be sustained upon examination, measured at the largest amount that has a

greater than 50% likelihood of being realized upon settlement. Additionally, FIN 48 gives guidance on

derecognition, classification, interest, penalties, accounting in interim periods and disclosure related to

uncertain tax positions. Any adjustment resulting from the adoption of FIN 48 will be recorded as an

adjustment to our accumulated deficit in the Consolidated Balance Sheets. FIN 48 is effective for fiscal

periods beginning after December 15, 2006. We are currently assessing the effect FIN 48 may have, if

any, to our consolidated results of operations and financial position.

Note 3: Acquisitions, Divestitures and Other Transactions

Acquisitions

Sky Transactions

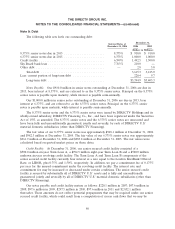

During 2006 we completed the last in a series of transactions with News Corporation, Grupo

Televisa, S.A., or Televisa, Globo Comunicacoes e Participacoes S.A., or Globo, and Liberty Media

International, or Liberty, which we refer to as the Sky Transactions as further described below. The Sky

Transactions resulted in the combination of the direct-to-home satellite platforms of DIRECTV and

SKY in Latin America into a single platform in each of the major territories in the region.

Brazil. On August 23, 2006, we completed the merger of our Brazil business, Galaxy Brasil Ltda.,

or GLB, with and into Sky Brazil, and completed the purchase of News Corporation’s and Liberty’s

interests in Sky Brazil. As a result of these transactions, we hold a 74% interest in the combined

business. The purchase consideration for the transactions amounted to $670.0 million, including

$396.4 million in cash paid, of which we paid $362.0 million to News Corporation and Liberty in 2004

and $30.0 million to News Corporation in August 2006, the $63.6 million fair value of the reduction of

our interest in GLB resulting from the merger and the assumption of Sky Brazil’s $210.0 million bank

loan.

We accounted for the Sky Brazil acquisition using the purchase method of accounting, and began

consolidating the results of Sky Brazil from the date of acquisition. We also accounted for the

reduction of our interest in GLB resulting from the merger as a partial sale pursuant to EITF

No. 90-13 ‘‘Accounting for Simultaneous Common Control Mergers,’’ which resulted in us recording a

one-time pre-tax gain during the third quarter of 2006 of approximately $60.7 million in ‘‘Gain from

disposition of businesses, net’’ in the Consolidated Statements of Operations. The December 31, 2006

consolidated financial statements reflect a preliminary allocation of the $670.0 million purchase price to

the assets acquired and the liabilities assumed based on their estimated fair values at the date of

acquisition using information currently available. The assets acquired included approximately

$41.5 million in cash. Amounts allocated to tangible and intangible assets, primarily subscriber related,

deferred tax assets and liabilities, and accrued liabilities are estimates pending the completion of

independent appraisals and additional analyses currently in process. Based on preliminary estimates, we

have allocated $288.6 million to amortizable intangible assets that are included in ‘‘Intangible Assets,

net’’ in our Consolidated Balance Sheets and will be amortized over a period of 6.0 years. The excess

76