DIRECTV 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

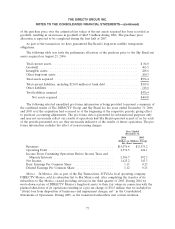

Hughes Software Systems

In the second quarter of 2004, HNS agreed to sell its approximate 55% ownership interest in HSS

for $226.5 million in cash, which we received in June 2004. As a result of this sale, we recognized a

$90.7 million gain, net of taxes, during 2004 included in ‘‘Income (loss) from discontinued operations,

net of taxes’’ in our Consolidated Statements of Operations.

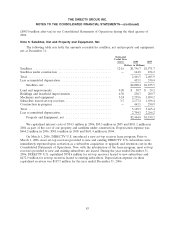

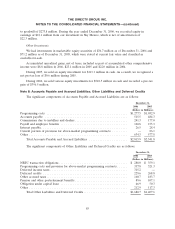

Operating results of the discontinued operations of HSS are as follows:

Years Ended

December 31,

2004

(Dollars in

Millions)

Revenues .................................................... $26.0

Income before income taxes ....................................... $ 5.4

Income tax expense ............................................. (0.6)

Minority interests and other ....................................... (2.1)

Net income from discontinued operations, net of taxes ................... $ 2.7

Other Discontinued Operations

As discussed in more detail in Note 20, during 2005, we recorded a $31.3 million gain in ‘‘Income

(loss) from discontinued operations, net of taxes’’ in our Consolidated Statements of Operations that

resulted from a favorable tax settlement related to a previously discontinued operation.

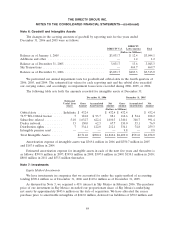

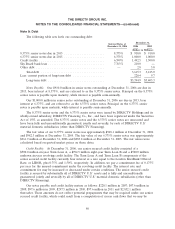

‘‘Income (loss) from discontinued operations, net of taxes,’’ as reported in the Consolidated

Statements of Operations, is comprised of the following:

Years Ended December 31,

2005 2004

(Dollars in Millions, Except

Per Share Amounts)

Income from discontinued operations, net of taxes ............ $ — $ 50.8

Gain (loss) on sale of discontinued operations, net of taxes ...... 31.3 (633.1)

Income (loss) from discontinued operations, net of taxes ...... $31.3 $(582.3)

Basic and Diluted Earnings (Loss) Per Common Share:

Income from discontinued operations, net of taxes ............ $ — $ 0.04

Gain (loss) on sale of discontinued operations, net of taxes ...... 0.02 (0.46)

Income (loss) from discontinued operations, net of taxes .... $0.02 $ (0.42)

Severance and Related Costs

As a result of the transactions above, as well as our split-off from General Motors on

December 22, 2003, during 2004 we recognized $169.5 million in charges for retention benefits,

severance and related costs under our pension benefit plans in ‘‘General and administrative expenses’’

in the Consolidated Statements of Operations. We recorded $113.0 million of charges at Corporate and

81