DIRECTV 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

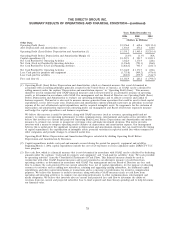

the number of high risk subscribers added to our platform, an increase in the number of HD and DVR

subscribers, and initiatives to further improve customer service.

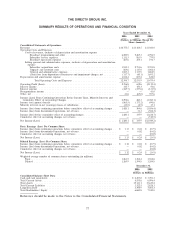

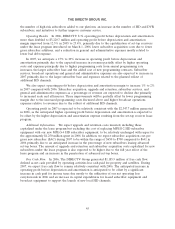

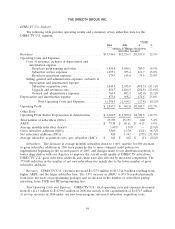

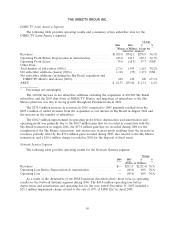

Operating Results. In 2006, DIRECTV U.S. operating profit before depreciation and amortization

more than doubled to $3,220.7 million and operating profit before depreciation and amortization

margin improved from 12.3% in 2005 to 23.4%, primarily due to the capitalization of set-top receivers

under the lease program introduced on March 1, 2006, lower subscriber acquisition costs due to fewer

gross subscriber additions, and a reduction in general and administrative expenses mostly related to

lower bad debt expense.

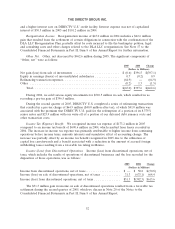

In 2007, we anticipate a 15% to 20% increase in operating profit before depreciation and

amortization primarily due to the expected increase in revenues partially offset by higher operating

costs and expenses principally due to higher programming costs from annual programming rate

increases, the larger subscriber base and the added cost of new programming contracts. Subscriber

services, broadcast operations and general and administrative expenses are also expected to increase in

2007 primarily due to the larger subscriber base and expenses related to the planned rollout of

additional HD channels.

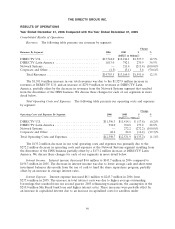

We also expect operating profit before depreciation and amortization margin to increase 1% to 2%

in 2007 compared with 2006. Subscriber acquisition, upgrade and retention, subscriber services, and

general and administrative expenses as a percentage of revenue are expected to decline due primarily

to increased scale and efficiencies. These improvements will be partially offset by lower programming

margin due to the increased programming costs discussed above and higher broadcast operations

expenses relative to revenues due to the rollout of additional HD channels.

Operating profit in 2007 is expected to be relatively consistent with the $2,347.7 million generated

in 2006, as the anticipated higher operating profit before depreciation and amortization is expected to

be offset by the higher depreciation and amortization expense resulting from the set-top receiver lease

program.

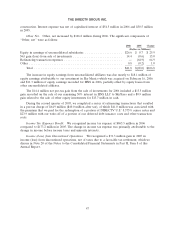

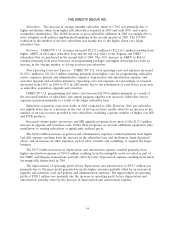

Additional Information. We expect upgrade and retention costs incurred, including those

capitalized under the lease program but excluding the cost of replacing MPEG-2 HD subscriber

equipment with our new MPEG-4 HD subscriber equipment, to be relatively unchanged with respect to

the approximately $1,250 million spent in 2006. In addition, we expect subscriber acquisition cost per

gross new subscriber (SAC) during 2007 to be within the range of $650 to $700 compared to $641 in

2006 primarily due to an anticipated increase in the percentage of new subscribers leasing advanced

set-top boxes. The amount of upgrade and retention and subscriber acquisition costs capitalized for new

subscribers under the lease program is also expected to be higher due to the full year effect of the

lease program and an increase in the penetration of advanced set-top boxes.

Free Cash Flow. In 2006, The DIRECTV Group generated $1,185.9 million of free cash flow,

defined as net cash provided by operating activities less cash paid for property and satellites. During

2007, we expect free cash flow to remain relatively consistent with 2006. The anticipated increase in

operating profit before depreciation and amortization is anticipated to be offset by a significant

increase in cash paid for income taxes due mostly to the utilization of our net operating loss

carryforwards in 2006 and an increase in capital expenditures for leased subscriber equipment and

broadcast equipment to support the launch of new local HD channels.

45