DIRECTV 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

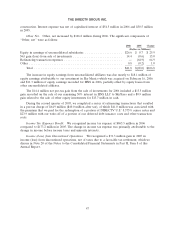

amortization and operating loss in 2004 include asset impairment charges of $1,466.1 million related to

SPACEWAY and $190.6 million for the SkyTerra transactions, as well as $25.6 million in severance

charges associated with the HNS related transactions discussed above in ‘‘Divestitures.’’

Corporate and Other

The elimination of revenues decreased to $5.1 million in 2005 from $178.2 million in 2004. The

revenue elimination resulted mostly from the elimination of sales from HNS to DIRECTV prior to the

sale of HNS’ set-top receiver manufacturing business in June 2004.

The operating loss from Corporate and Other decreased to $89.9 million in 2005 from

$220.8 million in 2004. Operating loss in 2004 included $16.5 million in higher stock compensation costs

and non-recurring charges in the amount of $113.0 million for retention benefits, severance and related

costs under our pension benefit plans resulting from headcount reductions and the strategic

transactions discussed above.

LIQUIDITY AND CAPITAL RESOURCES

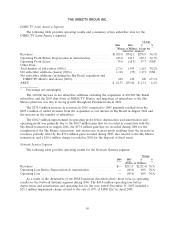

At December 31, 2006, our cash and cash equivalent balances and short-term investments totaled

$2.67 billion compared with $4.38 billion at December 31, 2005. The $1.71 billion decrease resulted

primarily from the use of $2.98 billion of cash for the share repurchase program, $1.98 billion of cash

for the acquisition of property and satellites, $373.0 million of cash for the acquisition of our equity

interest in Sky Mexico, and $100.2 million of cash for the repayment of other long-term obligations.

These cash uses were partially offset by $3.16 billion of cash provided by operations, $182.4 million of

cash received from the sale of investments including the investments in HNS LLC and a portion of our

investment in Sky Mexico, $257.1 million of cash received from the exercise of stock options by

employees, and $141.6 million of cash received from the collection of notes receivable.

As a measure of liquidity, the current ratio (ratio of current assets to current liabilities) was 1.37 at

December 31, 2006 and 2.16 at December 31, 2005. Working capital decreased by $2,035.2 million to

$1,233.1 million at December 31, 2006 from working capital of $3,268.3 million at December 31, 2005.

The decrease in our current ratio during the period was mostly due to the decline in our cash and

short-term investment balances resulting from the changes discussed above.

As of December 31, 2006, DIRECTV U.S. had the ability to borrow up to $500 million under its

existing credit facility. The DIRECTV U.S. credit facility is available until 2011. DIRECTV U.S. is

subject to restrictive covenants under its credit facility. These covenants limit the ability of DIRECTV

U.S. and its respective subsidiaries to, among other things, make restricted payments, including

dividends, loans or advances to us.

In 2006, we generated $1,185.9 million of free cash flow, defined as net cash provided by operating

activities less cash paid for property and satellites. During 2007, we expect free cash flow to remain

relatively consistent with 2006. An anticipated increase in operating profit before depreciation and

amortization is anticipated to be offset by a significant increase in cash paid for income taxes due

mostly to the utilization of our net operating loss carrforwards in 2006 and an increase in capital

expenditures for leased subscriber equipment and broadcast equipment to support the launch of new

local HD channels.

Through December 31, 2006, we have repurchased 184.1 million shares for $2.98 billion, at an

average price of $16.16 per share, under our $3.0 billion share repurchase program, which we

completed in February 2007.

56