DIRECTV 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

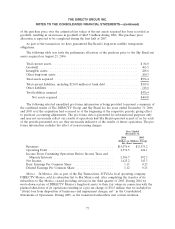

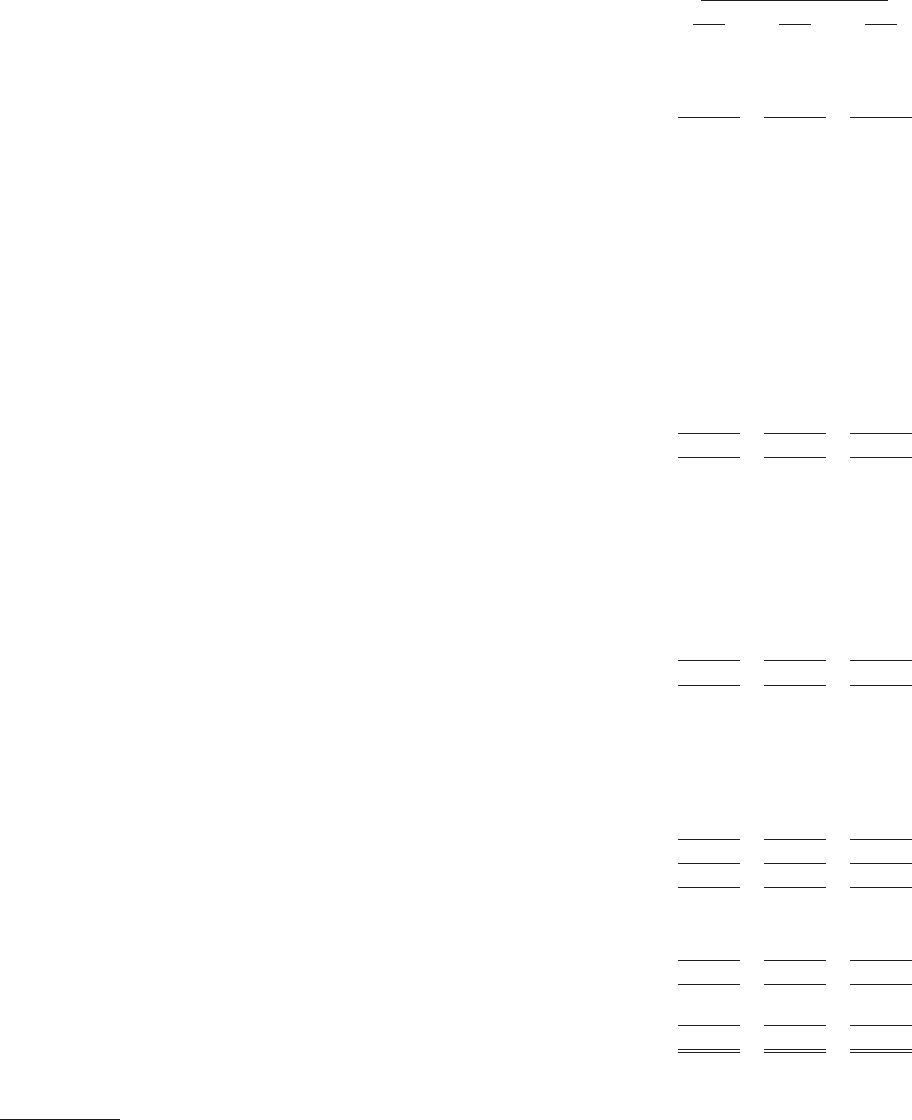

THE DIRECTV GROUP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31,

2006 2005 2004

(Dollars in Millions)

Cash Flows from Operating Activities

Net Income (Loss) .............................................. $1,420.1 $ 335.9 $(1,949.2)

Cumulative effect of accounting changes, net of taxes ........................ — — 310.5

Income (loss) from discontinued operations, net of taxes ...................... — (31.3) 582.3

Income (loss) from continuing operations before cumulative effect of accounting changes . 1,420.1 304.6 (1,056.4)

Adjustments to reconcile income (loss) from continuing operations before cumulative

effect of accounting changes to net cash provided by operating activities:

Depreciation and amortization ..................................... 1,034.4 853.2 838.0

(Gain) loss on disposition of businesses and impairment charges, net ............. (117.7) (45.1) 1,693.2

Equity in (earnings) losses from unconsolidated affiliates .................... (26.6) (0.7) 0.2

Net (gain) loss from sale of investments ............................... (14.4) 0.6 (396.5)

Loss on disposal of fixed assets .................................... 19.7 2.5 24.9

Share-based compensation expense .................................. 39.4 40.6 57.1

Write-off of debt issuance costs .................................... — 19.0 —

Deferred income taxes and other ................................... 770.0 188.1 (850.4)

Accounts receivable credited against Pegasus purchase price .................. — — (220.2)

Change in other operating assets and liabilities, net of assets and liabilities acquired

Accounts and notes receivable .................................... (282.8) (129.5) 18.8

Inventories ................................................ 139.0 (158.7) 23.2

Prepaid expenses and other ..................................... (11.7) (34.7) (20.8)

Accounts payable and accrued liabilities ............................. 158.3 312.1 (148.4)

Unearned subscriber revenue and deferred credits ....................... 1.5 15.1 60.7

Other, net ................................................ 32.8 (195.2) 205.2

Net Cash Provided by Operating Activities .......................... 3,162.0 1,171.9 228.6

Cash Flows from Investing Activities

Purchase of short-term investments ................................... (2,516.5) (4,672.7) (4,255.3)

Sale of short-term investments ...................................... 3,028.6 4,512.1 4,077.5

Investment in companies, net of cash acquired ............................ (389.5) (1.1) (388.5)

Cash paid for acquired assets ....................................... (4.0) (3.3) (965.8)

Cash paid for property and equipment ................................. (1,753.8) (489.2) (476.4)

Cash paid for satellites ........................................... (222.3) (399.5) (546.7)

Proceeds from sale of investments .................................... 182.4 113.1 510.5

Proceeds from collection of notes receivable .............................. 141.6 — —

Proceeds from sale of property ...................................... 13.2 — —

Proceeds from sale of businesses ..................................... — 246.0 2,918.4

Other, net ................................................... (15.9) (28.7) 13.1

Net Cash (Used in) Provided by Investing Activities .................... (1,536.2) (723.3) 886.8

Cash Flows from Financing Activities

Common shares repurchased and retired ................................ (2,977.1) — —

Net decrease in short-term borrowings ................................. (1.9) (2.5) (6.2)

Long-term debt borrowings ........................................ — 3,003.3 1.2

Repayment of long-term debt ....................................... (7.5) (2,005.5) (214.8)

Debt issuance costs ............................................. — (4.7) (2.4)

Excess tax benefit from share-based compensation .......................... 1.5 — —

Repayment of other long-term obligations ............................... (100.2) (90.5) (43.5)

Stock options exercised ........................................... 257.1 45.2 23.0

Net Cash (Used in) Provided by Financing Activities .................... (2,828.1) 945.3 (242.7)

Net cash and cash equivalents (used in) provided by continuing operations ...... (1,202.3) 1,393.9 872.7

Cash Flows from Discontinued Operations

Net Cash Provided by Operating Activities .......................... — — 276.1

Net Cash Provided by Investing Activities ........................... — — 62.5

Net Cash Used in Financing Activities ............................. — — (338.6)

Net cash and cash equivalents used in discontinued operations ..............———

Net (decrease) increase in cash and cash equivalents .......................... (1,202.3) 1,393.9 872.7

Cash and cash equivalents at beginning of the year ........................... 3,701.3 2,307.4 1,434.7

Cash and cash equivalents at end of the year ............................... $2,499.0 $ 3,701.3 $ 2,307.4

Supplemental Cash Flow Information

Cash paid for interest ............................................ $ 242.8 $ 239.5 $ 128.5

Cash paid (refunded) for income taxes ................................. 30.3 13.2 (49.2)

Reference should be made to the Notes to the Consolidated Financial Statements.

68