CarMax 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

December 15, 2008, and all prior-period earnings per share data presented shall be adjusted retrospectively. Early

application is not permitted. We are currently evaluating the impact of FSP EITF 03-6-1 on our consolidated

financial statements and will adopt FSP EITF 03-6-1 effective March 1, 2009.

In September 2008, the FASB issued exposure drafts that eliminate qualifying special purpose entities from the

guidance of SFAS No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of

Liabilities,” and FASB Interpretation 46 (revised December 2003), “Consolidation of Variable Interest Entities − an

interpretation of ARB No. 51,” as well as other modifications. While the proposed revised pronouncements have

not been finalized and the proposals are subject to further public comment, the changes could have a significant

impact on our consolidated financial statements as we could potentially be precluded from using sales accounting

treatment for our securitization transactions, which would change the timing of the recognition of CAF income. In

addition, the changes could result in the consolidation of the financial assets and liabilities transferred to our

qualified special purpose entities. The changes would be effective March 1, 2010, on a prospective basis.

In October 2008, the FASB issued FSP No. FAS 157-3, “Determining the Fair Value of a Financial Asset When the

Market for That Asset is Not Active,” (“FSP FAS 157-3”), which clarifies application of SFAS 157 in a market that

is not active. FSP FAS 157-3 was effective upon issuance, including prior periods for which financial statements

have not been issued. The adoption of FSP FAS 157-3 had no impact on our results of operations, financial

condition or cash flows.

In December 2008, the FASB issued FSP No. FAS 140-4 and FIN 46(R)-8, “Disclosures by Public Entities

(Enterprises) about Transfers of Financial Assets and Interests in Variable Interest Entities.” This disclosure-only

FSP improves the transparency of transfers of financial assets and an enterprise’ s involvement with variable interest

entities, including qualifying special-purpose entities. This FSP is effective for the first reporting period (interim or

annual) ending after December 15, 2008, with earlier application encouraged. We adopted this FSP for fiscal 2009.

The adoption of the FSP had no impact on our results of operations, financial condition or cash flows.

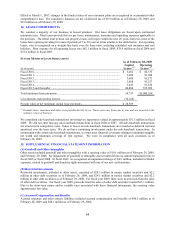

In December 2008, the FASB issued FSP No. FAS 132(R)-1, “Employers’ Disclosures about Postretirement Benefit

Plan Assets” (“FSP FAS 132(R)-1”). FSP FAS 132(R)-1 requires additional fair value disclosures about employers’

pension and postretirement benefit plan assets consistent with guidance contained in SFAS 157 (see Note 6).

Specifically, employers will be required to disclose information about how investment allocation decisions are

made, the fair value of each major category of plan assets and information about the inputs and valuation techniques

used to develop the fair value measurements of plan assets. This FSP is effective for fiscal years ending after

December 15, 2009. We are currently evaluating the impact the new disclosure requirements will have on our

consolidated financial statements and notes and will adopt FSP FAS 132(R)-1 effective March 1, 2009.

In April 2009, the FASB issued FSP No. FAS 157-4, “Determining Fair Value When the Volume and Level of

Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly”

(“FSP FAS 157-4”). FSP FAS 157-4 provides guidance on estimating fair value when market activity has decreased

and on identifying transactions that are not orderly. Additionally, entities are required to disclose in interim and

annual periods the inputs and valuation techniques used to measure fair value. This FSP is effective for interim and

annual periods ending after June 15, 2009. We are currently evaluating the impact of FSP FAS 157-4 on our

consolidated financial statements and will adopt this FSP effective June 1, 2009.

18. SUBSEQUENT EVENTS

In April 2009, we completed a term securitization totaling $1.0 billion of auto loan receivables and retained

subordinated bonds with a total face value of $140.0 million. This transaction was eligible for investors to utilize

the Federal Reserve’ s Term Asset-Backed Securities Facility (“TALF”) program.