CarMax 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

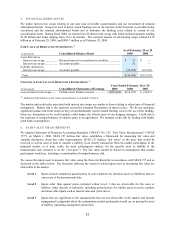

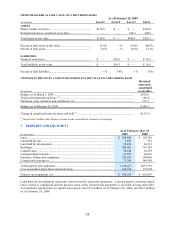

8. INCOME TAXES

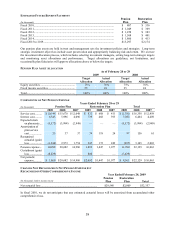

INCOME TAX PROVISION

Years Ended February 28 or 29

(In thousands) 2009 2008 2007

Current:

Federal .................................................................................. $ 69,095 $ 121,274 $ 120,250

State ...................................................................................... 9,992 18,175 18,671

Total.......................................................................................... 79,087 139,449 138,921

Deferred:

Federal .................................................................................. (37,835) (21,222) (13,596)

State ...................................................................................... (3,667) (3,183) (573)

Total.......................................................................................... (41,502) (24,405) (14,169)

Income tax provision.......................................................................... $ 37,585 $ 115,044 $ 124,752

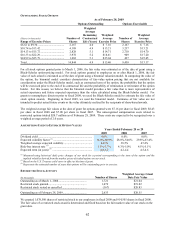

EFFECTIVE INCOME TAX RATE RECONCILIATION

Years Ended February 28 or 29

2009 2008 2007

Federal statutory income tax rate............................................... 35.0% 35.0% 35.0%

State and local income taxes, net of federal benefit................... 2.7 3.1 3.5

Nondeductible items.................................................................. 0.3 0.1 0.1

Valuation allowance .................................................................. 0.8 0.5 —

Effective income tax rate........................................................... 38.8% 38.7% 38.6%

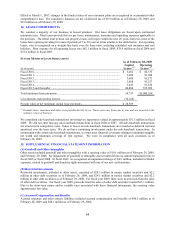

TEMPORARY DIFFERENCES RESULTING IN DEFERRED TAX ASSETS AND LIABILITIES

As of February 28 or 29

(In thousands) 2009 2008

Deferred tax assets:

Accrued expenses............................................................................................... $ 27,914 $ 28,972

Partnership basis ................................................................................................ 44,376 18,394

Inventory............................................................................................................ 2,108 —

Stock compensation ........................................................................................... 45,687 34,191

Capital loss carry forward.................................................................................. 2,413 1,636

Total gross deferred tax assets............................................................................... 122,498 83,193

Less: valuation allowance..................................................................................... (2,413) (1,636)

Net gross deferred tax assets.................................................................................. 120,085 81,557

Deferred tax liabilities:

Securitized receivables....................................................................................... 18,620 18,524

Prepaid expenses................................................................................................ 8,168 10,034

Inventory............................................................................................................ — 1,677

Depreciation and amortization ........................................................................... 2,263 1,966

Total gross deferred tax liabilities ......................................................................... 29,051 32,201

Net deferred tax asset ............................................................................................ $ 91,034 $ 49,356

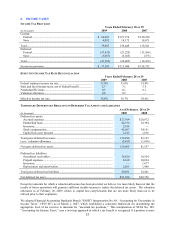

Except for amounts for which a valuation allowance has been provided, we believe it is more likely than not that the

results of future operations will generate sufficient taxable income to realize the deferred tax assets. The valuation

allowance as of February 28, 2009, relates to capital loss carryforwards that are not more likely than not to be

utilized prior to their expiration.

We adopted Financial Accounting Standards Board (“FASB”) Interpretation No. 48, “Accounting for Uncertainty in

Income Taxes” (“FIN 48”) as of March 1, 2007, which established a consistent framework for determining the

appropriate level of tax reserves to maintain for “uncertain tax positions.” This interpretation of SFAS No. 109,

“Accounting for Income Taxes,” uses a two-step approach in which a tax benefit is recognized if a position is more