CarMax 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements

– an amendment of ARB No. 51” (“SFAS 160”). SFAS 160 requires that noncontrolling (or minority) interests in

subsidiaries be reported in the equity section of our balance sheet, rather than in a mezzanine section of the balance

sheet between liabilities and equity. SFAS 160 also changes the manner in which the net income of the subsidiary is

reported and disclosed in the controlling company's income statement. SFAS 160 also establishes guidelines for

accounting for changes in ownership percentages and for deconsolidation. SFAS 160 is effective for financial

statements for fiscal years beginning on or after December 15, 2008, and interim periods within those years. As of

February 28, 2009, we did not hold any noncontrolling interests in subsidiaries.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities

– an amendment of FASB Statement No. 133” (“SFAS 161”), which expands the disclosure requirements about an

entity’ s derivative instruments and hedging activities. SFAS 161 requires that objectives for using derivative

instruments and related hedged activities be disclosed in terms of the underlying risk that the entity is intending to

manage and in terms of accounting designation. The fair values of derivative instruments and related hedged

activities and their gains are to be disclosed in tabular format showing both the derivative positions existing at

period end and the effect of using derivatives during the reporting period. Any credit-risk-related contingent

features are to be disclosed and are to include information on the potential effect on an entity’ s liquidity from using

derivatives. Finally, SFAS 161 requires cross-referencing within the notes to enable users of financial statements to

better locate information about derivative instruments. These expanded disclosure requirements are required for

every annual and interim reporting period for which a balance sheet and statement of operations are presented.

SFAS 161 is effective for any reporting period (annual or quarterly interim) beginning after November 15, 2008,

with early application encouraged. We adopted SFAS 161 for fiscal 2009. The adoption had no impact on our

results of operations, financial condition or cash flows.

In April 2008, the FASB issued FASB Staff Position (“FSP”) No. FAS 142-3, “Determination of the Useful Life of

Intangible Assets” (“FSP FAS 142-3”). FSP FAS 142-3 amends the factors that should be considered in developing

renewal or extension assumptions used to determine the useful life of a recognized intangible asset under SFAS No.

142, “Goodwill and Other Intangible Assets” (“SFAS 142”). In developing assumptions about renewal or extension,

FSP FAS 142-3 requires an entity to consider its own historical experience (or, if no experience, market participant

assumptions) adjusted for the entity-specific factors in paragraph 11 of SFAS 142. FSP FAS 142-3 expands the

disclosure requirements of SFAS 142 and is effective for financial statements issued for fiscal years beginning after

December 15, 2008, with early adoption prohibited. The guidance for determining the useful life of a recognized

intangible asset shall be applied prospectively to intangible assets acquired after the effective date. The disclosure

requirements shall be applied prospectively to all intangible assets recognized as of, and subsequent to, the effective

date. We believe the adoption of FSP FAS 142-3 will have no material impact on our results of operations, financial

condition or cash flows.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles”

(“SFAS 162”). SFAS 162 identifies the sources of accounting principles and the framework for selecting the

principles to be used in the preparation of financial statements of nongovernmental entities that are presented in

conformity with generally accepted accounting principles (“GAAP”) in the United States (“the GAAP hierarchy”).

SFAS 162 makes the GAAP hierarchy explicitly and directly applicable to preparers of financial statements, a step

that recognizes preparers’ responsibilities for selecting the accounting principles for their financial statements, and

sets the stage for making the framework of FASB Concept Statements fully authoritative. The effective date for

SFAS 162 is 60 days following the SEC’ s approval of the Public Company Accounting Oversight Board’ s related

amendments to remove the GAAP hierarchy from auditing standards, where it has resided for some time. The

adoption of SFAS 162 will have no impact on our results of operations, financial condition or cash flows.

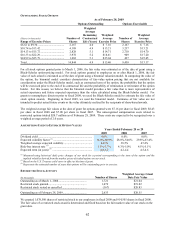

In June 2008, the FASB issued FSP No. EITF 03-6-1, “Determining Whether Instruments Granted in Share-Based

Payment Transactions Are Participating Securities” (“FSP EITF 03-6-1”). FSP EITF 03-6-1 addresses whether

instruments granted in share-based payment transactions are participating securities prior to vesting, and therefore

need to be included in the earnings allocation in computing earnings per share under the two-class method as

described in SFAS No. 128, “Earnings per Share.” Under the guidance of FSP EITF 03-6-1, unvested share-based

payment awards that contain nonforfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are

participating securities and shall be included in the computation of earnings per share pursuant to the two-class

method. Our restricted stock awards are considered “participating securities” because they contain nonforfeitable

rights to dividends. FSP EITF 03-6-1 is effective for financial statements issued for fiscal years beginning after